https://www.pv-magazine.com/2022/07/30/the-weekend-read-the-return-of-global-pv-manufacturing/

The weekend read: The return of global PV manufacturing

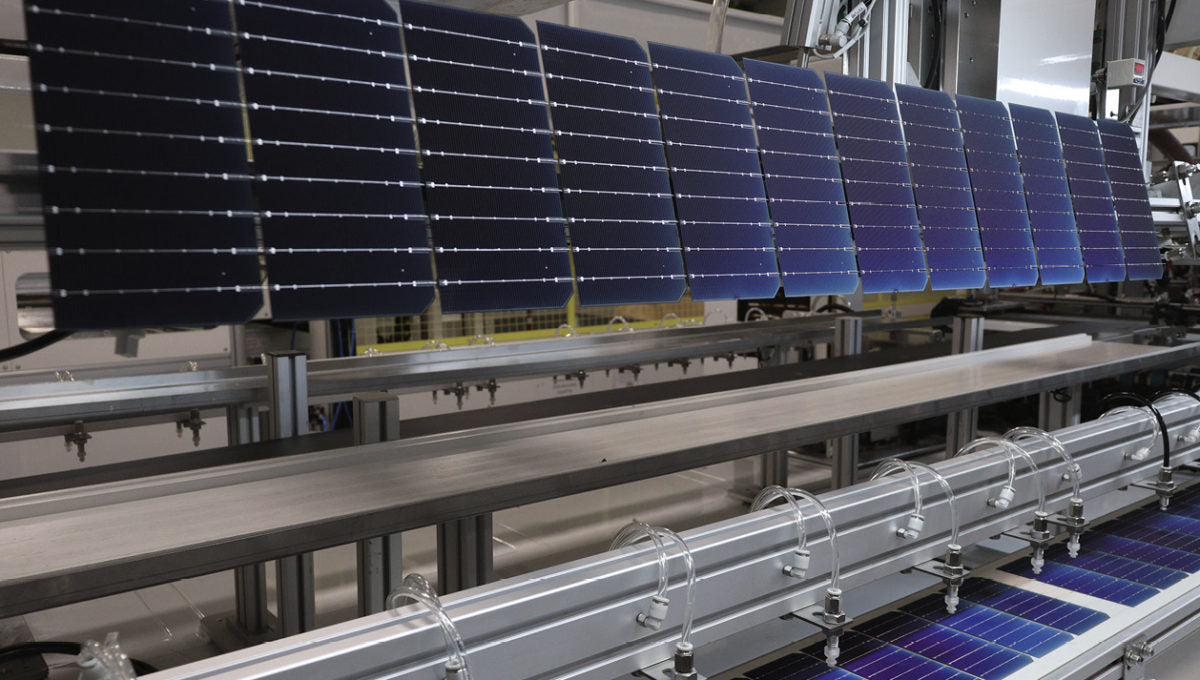

Technology developments, including half-cut cells and bifacial modules, were central to Smart Solar’s move into manufacturing.

Image: Smart Solar Technology

From pv magazine 07/2022

Ever since the demise of former PV manufacturing heavyweights in Europe such as Q-Cells and SolarWorld – as well as the Bosch abandonment of its €2 billion ($2.06 billion) investment in PV manufacturing in Germany – institutional investors have avoided the risk of business plans that involved large-scale PV manufacturing in Europe.

Yet in 2022, the times have changed. The ongoing sense of urgency to act on the acceleration of climate change is not entirely new, but what is new is a desire to no longer ignore which types of government benefit most from the export of fossil fuels.

Russia’s war waged on Ukraine since late February this year has thrust the issue of reducing Europe’s dependency on oil and gas imports from Russia as fast as possible to the front of all political debates. While this agenda acts as a booster to the already strong growth plans in the renewable energy industry, it also sheds light on another inconvenient truth: Europe cannot supply itself with the required components for an accelerated energy transition.

Fifteen years ago, Europe was home to the leading manufacturers in the PV industry. It still sports the highest per-capita investments in R&D activities in renewable technologies developed and advanced by state-funded research institutes.

China’s role

A sober assessment of the supply side of the global industry for components for PV and wind power installations draws the conclusion that over the past decade the world has become completely dependent on Chinese manufacturers for the key components required to implement the global energy transition.

Large, integrated Chinese PV manufacturers now control more than 90% of the global market with their production facilities for wafers, cells, and modules, as well as a large portion of the solar inverter market. Production facilities are based in China and neighboring countries in Southeast Asia, such as Vietnam and Malaysia. Only a very limited number of European module and inverter manufacturers are left after the industry was severely harmed by the inconsistency of the renewable policies implemented at the national level in Europe.

Effectively the world is exchanging its dependency on fossil fuel exporting countries such as Russia, the Gulf region, Venezuela, and Brazil to cover its energy needs for a dependency on Chinese manufacturers of the key components for renewable power plants. This prospect cannot be reassuring.

In March 2022, European Commissioner for Energy Kadri Simson pledged to do “whatever it takes” to make sure that solar manufacturing returns to the region. It is well understood the new players hoping to emerge will have to operate at multi-gigawatt annual production capacities to make any impact on the market, as well as giving the new players any chance of becoming cost-competitive with their Asian rivals.

Turkey’s bridge

Two companies based in Turkey, right on the border of Europe, are in the process of establishing cell and module production capacities on the order of 2 GW to 2.5 GW, and each without direct state subsidies. One is Smart Solar Technology, that started as an independent power producer (IPP) company founded in 2009 in Bulgaria. Over the course of 13 years, Smart Solar Technology has developed from a regional IPP player in eastern Europe to adding EPC services for third parties in that region in 2013-14, before eventually making the leap into module manufacturing in 2016-17.

The initial annual production capacity of the module factory east of Istanbul was around 400 MW. Since then, the factory has seen two capacity upgrades and now operates at more than 1 GW annually of state-of-the-art module production.

With the decision to run three divisions (IPP, EPC and manufacturing) back in 2015, founder Halil Demirdağ convinced his colleague from university, Hakan Akkoç, to join the executive board of Smart Solar as COO and CTO, responsible for procurement and manufacturing. While both had been musing the opportunity to further integrate operations upstream and venture into cell manufacturing as early as 2019, it was at the height of the Covid-19 crisis in February 2021 that both agreed it was inevitable for Smart Solar to maintain growth prospects.

The manufacturing shutdowns that occurred due to Covid-19 outbreaks around the world, together with the hiccups and increasing delays in international shipments led both executives to the conclusion that the time to invest in cell manufacturing was now. For this strategic decision to yield the expected benefits there were no doubts that the cell and module manufacturing capacities should match from the start. The financing required for such a commitment by Smart Solar Technology meant the company required external investors.

Popular content

At a time when most companies were considering (at least temporary) layoffs and postponement of investment plans, Smart Solar took the bold decision to go public and move forward on its cell manufacturing ambitions. An important ingredient to the Smart Solar manufacturing plan was keeping up with technological developments in the module space, including half-cut cells and bifacial modules.

With its own PV projects installed in the years 2011 to 2013, Smart Solar evaluated the offerings of module manufacturers from around the world. Like any other project developer, the company sought the most cost-efficient modules to install in its PV power plants. When discussing the objectives for his IPP business with the Chinese solar manufacturer Phono Solar, a subsidiary of Sumec Group, Halil Demirdağ concluded that Phono Solar was able to provide him with the type of modules he was looking for: a module that was optimized for stability and energy yield. In terms of price per Wp, Phono Solar’s modules certainly were not the cheapest on the market, but as an IPP, Smart Solar’s focus was on lowest lifetime cost per kWh of electricity generated, rather than lowest investment cost. Phono Solar’s modules matched this objective much better compared to the offerings of most of their competitors.

Local content

An external event then led to Smart Solar’s decision to establish module production in Turkey. The country announced it would grant higher feed-in tariffs to PV installations that fulfilled certain domestic content requirements. These requirements could only be met if at least the modules were manufactured locally. By entering a partnership with Sumec Group for its production plans, Smart Solar could benefit from all the expertise Phono Solar had gained over the years.

With the help of Phono Solar, Smart Solar was able to establish its module manufacturing capacity in less than four months, while also benefitting by using the same components that went into the already certified modules of their Chinese partner, to ensure the new module certification process was swift.

For Sumec Group, the cooperation with Smart Solar Technology had obvious benefits: a module production facility not impacted by any EU tariffs, and a product that could easily recuperate its price premium in the Turkish market, because the electricity generated with these modules was remunerated at a higher tariff in Turkey.

This domestic price premium explains Smart Solar’s international sales accounting for just 10% of its total revenue. After all, why sell your modules abroad if they can command a higher price in your home market? Despite this clear preference for domestic sales, Smart Solar has maintained operations in several regions, supplying modules to more than eight countries in Asia and Europe.

The medium-term project pipeline of the IPP branch of Smart Solar, which is not part of the stock-listed entity, sees the company adding multi-MW power plants in countries such as Italy, Spain, and the United States. A new cell factory will start production in early 2023, manufacturing p-type PERC cells, with a claimed efficiency above 22%, with the factory able to transition to n-type soon after.

IPO – how so?

Despite being a comparatively small stock market transaction raising $36 million, Smart Solar’s IPO stands out. In the first half of 2022, it capped one of the worst six-month periods in the past 20 years in terms of global stock price development. But Smart Solar’s IPO has stayed above its listing price, giving the company a post-IPO valuation of close to $150 million. In fact, the share price has appreciated since its first day of trading by more than 50%. To our knowledge, the IPO of Smart Solar Technology was the first IPO of any crystalline PV manufacturer in the Western Hemisphere in at least the past five years, if not even the last decade.

Most of the proceeds of the IPO are earmarked for the construction of a 2 GW cell factory and a 1 GW module assembly facility near Izmir on the Mediterranean coast. Expanding the vertical integration while raising the overall production capacity was the key selling point of the equity story.

In a future edition of pv magazine, we will further analyze an even bolder move into the photovoltaic manufacturing space by a Turkish company, Kalyon PV. It established a greenfield 1 GW integrated wafer, cell and module production plant at a site about 50 km southwest of Turkey’s capital, Ankara.

By Götz Fischbeck

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.