https://www.pv-magazine.com/2022/08/13/the-weekend-read-hype-and-hope-for-solid-state-batteries/

The weekend read: Hype and hope for solid-state batteries

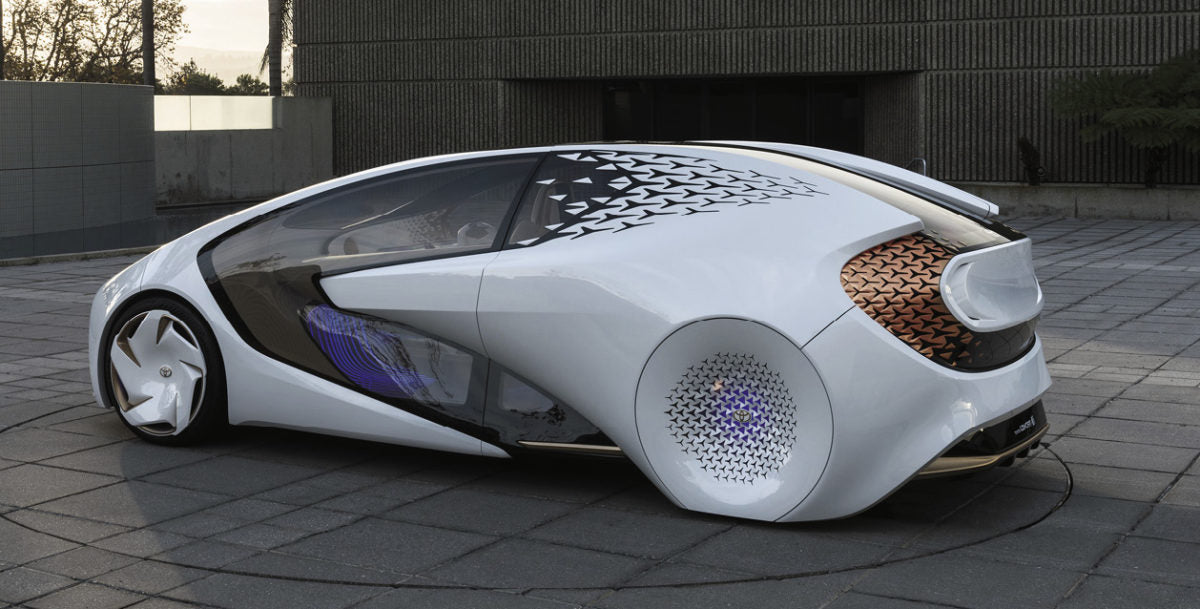

Toyota’s Concept-i 02. The Japanese automaker has produced prototype electric vehicles powered by solid-state batteries, but says its first production vehicle to feature the technology will be a hybrid, as it expects SSBs to initially be too expensive for a full electric vehicle requiring a larger battery.

Image: Toyota

From pv magazine 08/2022

It is a moment of truth for dozens of companies working on SSBs as their technology emerges from cloistered labs and makes its way to the factory floor. Having mobilized big investment, SSB makers now need to prove that they have not only solved the challenges associated with using solid electrolytes, but commercial scale success as well. If proven, SSBs will be in a position to deliver on the twin promise of improved performance and safety compared to their ubiquitous, liquid-filled cousins. “When it comes to the commercial viability of SSBs, there of course we must differentiate between the technology classes – SSBs based on polymer electrolyte are on the market already, but those based on oxide and sulfide electrolytes are mostly in the prototype phase,” says Thomas Schmaltz of the German Fraunhofer Institute for Systems and Innovation Research (ISI).

Schmaltz and his colleagues have developed a roadmap where the three most promising solid electrolyte variants were examined and compared with the anticipated developments in liquid electrolyte lithium-ion batteries (LIBs). Their results showed that SSBs must demonstrate significant performance improvements relative to state-of-the-art LIBs to obtain any relevant market share. What is more, they will need to do that fast.

“There is always a certain window of opportunity and there is always reluctancy to switch to new technologies. All KPIs for LIBs are continuously improving and it might soon become difficult to increase KPIs [key performance indicators] of SSBs such as energy density and safety significantly enough to justify the higher costs,” Schmaltz says. He estimates that SSBs will need to prove their viability within the next five years to have any chance of fast market penetration.

In terms of expected market developments, SSB production – currently below 2 GWh globally and based on polymer SSB – is anticipated to increase significantly between 2025 and 2030, when oxide and sulfide electrolyte-based SSBs start to roll off manufacturing lines in bigger quantities. According to the Fraunhofer ISI roadmap, production capacity is estimated to be between 15 and 55 GWh in 2030 and between 40 and 120 GWh in 2035 – still under 2% of the expected LIB market.

Flurry of activity

The findings mirror announcements from CATL, the world’s largest electric vehicle (EV) battery maker. Earlier this year, it said SSBs won’t be mass produced for retail electric cars before 2030 at the earliest, following first emergence from its labs by 2025. Following in its footsteps, battery makers Samsung SDI, SKI, and LG are readying their SSBs for market introduction in 2027, 2029, and after 2030, respectively. Meanwhile, the joint venture between Panasonic and Japanese car giant Toyota has already presented a prototype car equipped with an SSB.

Toyota, despite failing to capitalize on its early success in hybrid EVs, is now taking the lead among car makers with over 1,000 SSB patents. It is pumping more than $35 billion into EVs by the end of the decade, around half of which is going into battery R&D. However, earlier this year, the car maker made it clear that the first Toyota with SSBs will be a hybrid, serving as a testbed. “Solid-state batteries are not so cheap yet and a full-sized one in a BEV may make the car price exorbitant,” says Toyota’s chief scientist Gill Prat.

Meanwhile, Japanese rivals Nissan and Honda have revealed plans to establish SSB manufacturing lines in-house. Western automakers, including Volkswagen, Mercedes-Benz, Stellantis, BMW, and Ford, are also exploring SSBs through partnerships with start-ups.

Technological challenges

Today, there are three competing ways to do solid-state electrolyte, and each has its own set of technological bottlenecks. “In the EV space, sulfide-based solid electrolytes are particularly promising with some of the major developers, including CATL, BYD, Samsung SDI, and Toyota amongst others, focused on this technology class,” says Max Reid, research analyst at Wood Mackenzie. “It contains abundant materials and has a relatively high lithium-ion conductivity compared with other solid electrolytes, indicating better performances for more cycles. Yet, the material is instable in air and releases H2S gas which is poisonous as well as flammable.”

The second approach, the oxide-based electrolyte, is chemically the most stable version. But its manufacturing process, particularly the high-temperature sintering procedures, makes mass production no easy business.

“Their separator layer is brittle, and it cannot be rolled up, so that means you have to stack a cell like a deck of cards. There is no established process today, so it remains to be seen if it can be done in a cost-effective manner,” says Jon Jacobs, chief marketing officer at Solid Power, a Colorado-based start-up specializing in sulfide SSBs that is backed by BMW and Ford. Solid Power claims to be using the same processes and equipment as in current state-of the art LIB manufacturing.

Finally, there are polymer-based solid electrolytes, which are much easier to manufacture compared to the other two classes. “For polymers an extrusion process using no solvent is already established and used commercially,” says Schmaltz of Fraunhofer ISI. “If scaled-up this could be an even cheaper production technique than the established ones for LIBs.”

However, SSBs with polymer-based electrodes have a common ionic conductivity of only 10-7S/cm at room temperature, below the level of current liquid electrolytes. They also have a very poor oxidation stability with high-voltage cathodes (only compatible with LiFePO4/LFP), all of which means the energy density of polymer-based batteries is greatly undermined.

Cost is king

What we hear today from many developers involved in the SSB space is that they have fixes in place for these challenges and now many are facing the next big issue: high cost. “The cost of solid-state batteries may be well above current LIBs. While the higher energy density will save module and pack costs, replacing graphite anodes with thin lithium metal foil, and replacing liquid electrolytes with solids containing elements like germanium and lanthanum would represent a cost increase,” says Reid of WoodMac. Specifically, looking at the SSB supply chain, there are not many advantages to be seen. “Lithium metal anode material is a clear bottleneck. This could see cell producers choose a more abundant anode material – silicon – which promises high performances but not as high as lithium metal. Otherwise, SSBs use essentially the same amount of cathode materials as current LIBs, depending on cell voltage.” This means that SSBs will face the same challenges evident in the battery space today.

The cost will not only depend on raw materials, but also investment in manufacturing processes and tooling. To an extent, it would be possible to use the equipment at existing Li-ion factories to produce SSBs. Namely, while the cathode structure can be the same as current LIBs and the same equipment can be used in SSB manufacture, the anode will likely be completely different.

“Either lithium metal foils will be delaminated into the cell structure, or a proprietary technique will be used to build a silicon anode, [using] relatively new techniques,” Reid says. “Then with the electrolyte, injecting liquids will be replaced by solid electrolyte manufacturing techniques. It would be a monumental change to a current factory’s process, and with each gigafactory costing $3 billion or so, it would be rather costly to retrofit these facilities to producing just SSBs.”

Popular content

Specifically, cost of production of oxide-based and sulfide-based electrolyte is higher, so initially they are less likely to be applied in sectors that are more cost-sensitive than the automotive sectors, such as the stationary storage industry. Here, the requirements are less on performance in a small space/mass, so today polymer electrolytes are the most popular choice in stationary storage applications. Polymer-based SSBs have already been deployed in the field, such as in minigrid projects carried out by France’s Blue Solutions, the first SSB maker to achieve mass manufacturing in the hundreds of MWh.

The potential of the other two electrolyte classes in stationary storage has yet to be fully proven. Yet there is movement afoot. Earlier this year, German and US-owned energy storage heavyweight Fluence entered into a multi-year agreement with US battery start-up QuantumScape to introduce oxide-based SSB technology in stationary storage applications.

“We are working together to validate and test QuantumScape’s SSB cells for use in Fluence’s proprietary stationary storage products. Our team is particularly excited about the potential for oxide SSBs to enable lithium metal anodes, with the corresponding cost, and density improvements that would be gained,” says Brett Galura, SVP, Fluence Next and CTO. “These features can help shrink installation footprints by one-third and offer safety characteristics that require fewer system-level components, simplifying total system safety approaches.”

Proof of performance

Indeed, more power and more safety are often quoted as the main perks of the SSB technology, with the greater energy densities and faster recharge times compared to LIBs regularly claimed. Proven results, though, are harder to come by. “The market players claim that their SSBs have superior performance but it’s very hard to judge the actual numbers, if they even give these. Only third-party tested values could allow for an independent evaluation of the actual cell performances,” says Schmaltz.

Taiwanese SSB start-up Prologium, which earlier this year entered into a technology cooperation agreement with Mercedes-Benz, says its protoypes are already in testing: “To date, ProLogium has shipped more than 7,300 EV cells with 50 – 60 Ah capacity to worldwide automotive partners for verification, and more than one million cells have been delivered to customers for consumer applications,” says Lisa Hsu, Prologium deputy director of marketing division.

The cell maker acknowledges that it faces challenges in scaling up production capacity globally at a pace to fulfill customer demand. “[Prologium is] the only solid-state lithium ceramic battery maker capable of producing at scale and providing stable supply for the global EV industry,” she says. The plan is to launch the company’s first 3 GWh production plant in early 2023.

Earlier this year, a battery with ceramic separator and a capacity of 2.5 kWh was unveiled together with Taiwanese scooter manufacturer Gogoro, which has an extensive network of battery swap infrastructure. When it comes to technology perks, Prologium has a long list including an almost 80% higher pack energy density, more than 60% faster charge, and lower price, along with recycling 90% of the solid-state electrolyte.

Other specialists in the field are also eager to highlight the benefits of SSBs over LIBs, particularly for the automotive sector. “There’s a lot of smoke and mirrors out there but cost is always most important,” says Jacobs of Solid Power. “The first benefit is higher energy density which makes it possible to pack around 30 to 40% more energy in the SSB cell than in today’s best liquid-based LIB cells and give the automaker a choice to boost the range or reduce the number of batteries they need inside and thus save money.” The company’s B sample EV cell is targeted to be 390 Wh/kg and 930 Wh/L.

An additional advantage is that car makers could enjoy further savings by eliminating the battery pack cooling system. “When today’s liquid LIBs get hot, even when the car is just parked in the sun, the cells will degrade. SSBs like to be hot,” says Jacobs. But while being arguably the most promising start-up working on sulfide electrolytes, Solid Power still has a long way to go to start manufacturing at scale, currently making just 150 kg of electrolyte per month; but it is scaling up.

“Our coming second facility could be expanded to make up to 10 tons per month, which is sufficient to make thousands of EV cells per year, which is what the automakers need to do validation testing, but that’s not enough cells to supply a car program,” Jacobs says. “To give you some idea, 10 GWh could supply between 100,000 and 200,000 vehicles, so right now our capacity to make cells and power is in the hundreds of MWh.”

SSBs pick-and-mix

Cathode: The same as in state-of-the-art LIB, including transition metal-based oxides (NMC, NCA) and lithium iron phosphate (LFP), with supply chain and processing routes already established.

Anode: While graphite has been demonstrated to function in several solid electrolyte cell concepts, lithium metal and silicon are the go-to anode active materials. Lithium metal is considered the most promising as it enables the highest possible energy density on the anode side.

Solid electrolyte type: Oxide, sulfide, and polymer are three predominant classes today, although mixed approaches are also possible.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.