https://www.pv-magazine.com/2023/03/18/weekend-read-as-simple-as-ibc/

As simple as IBC

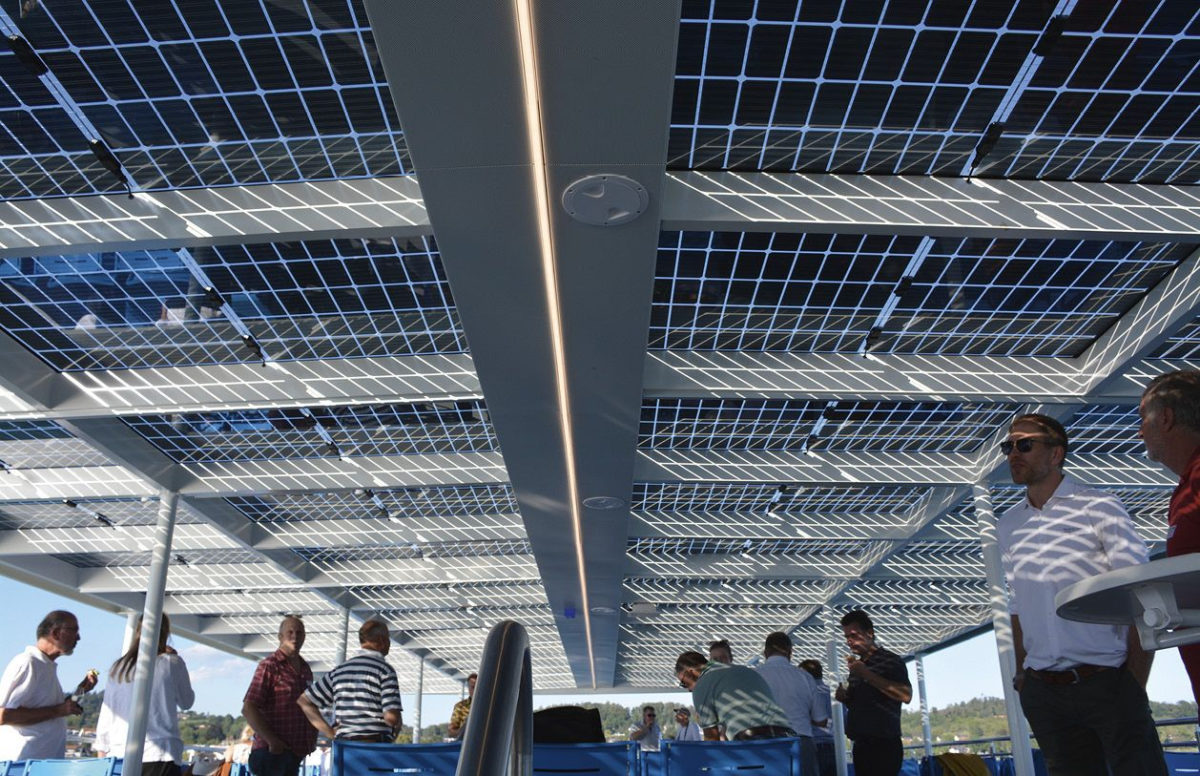

Modules featuring ISC Konstanz’s Zebra cells are installed on a ferry that takes passengers across Lake Constance in southern Germany.

Photo: ISC Konstanz

IBC solar cells were conceived in the 1970s and the idea behind them is simple: Move all contacts, metallization, and other inner workings of the cell to the rear side, leaving the front, active layer unobstructed and open to more sunlight.

That approach ensures IBC, and other back-contact type devices, can push closer to the practical limit for single-junction silicon cell conversion efficiency than other cell architectures. That goal has kept them in focus for researchers, with many of the highest in-lab efficiencies coming from back-contact structures.

Processing back-contact cells at scale, however, has proven difficult and expensive. The resulting lack of adoption means comparisons with mainstream approaches are difficult. “As the scale of back contact is small and it’s mostly used in distributed-generation projects that pursue better appearance, it has a higher premium,” says Corrine Lin, chief analyst at renewables market intelligence company InfoLink. “Based on the product pricing of current manufacturers, there’s usually a premium of $0.01/W, or even higher, compared with PERC [passivated-emitter, rear contact solar]. However, there’s no clear premium index due to smaller trading volumes and different target markets.”

Most large manufacturers took a simpler route to boost efficiency, but with more cost-effective avenues approaching exhaustion – and researchers at Germany’s Institute for Solar Energy Research Hamelin last year calculating back-contact devices could hit 29.1% efficiency – renewed attempts to commercialize back-contact cells are afoot.

IBC advantage

US company SunPower Corporation manufactured IBC cells for more than 20 years. Its products have been particularly successful in the residential market, where the aesthetic appearance and superior efficiency and reliability is highly valued, resulting in a price premium. In 2020, SunPower separated its manufacturing business to form a new company, Maxeon Solar Technologies, which continues to manufacture IBC products under the SunPower and Maxeon brands.

Doug Rose, vice president for technology strategy at Maxeon, explains the back contact structure enables the full optimization of the front surface, maximizing light into the cell and minimizing recombination, instead of also having to optimize for metal coverage and lateral conduction to the metal fingers. On the rear side, the IBC provides the opportunity for thicker metal, resulting in lower series resistance.

Rose adds that, alongside efficiency, superior reliability is also a focus for Maxeon, and having a premium product allows it to make design and materials choices resulting in reliability that is better than standard – it offers a product warranty of up to 40 years in some markets.

A key advantage of Maxeon’s IBC products is that they have a unique, non-damaging reverse-bias behavior. This prevents hot-spots – which can cause damage to cells and modules – even in partial shade with module diodes that have failed. “We believe this provides additional value and differentiation and we have put a lot of effort into extending the advantage in this area in our coming generation.” Rose further explains that the ability to do this is another inherent advantage of back contact technology, though not present in all back contact architectures.

State of play

There are high hopes for back-contact solar. Radovan Kopecek, co-founder and director of German institute the International Solar Energy Research Center (ISC) Konstanz, told pv magazine in November, IBC modules could overtake TOPCon (tunnel-oxide, passivated contact) products by 2028 and make up half of the market in 2030. Other market observers are less bullish but agree that back contact technologies will likely see growth over the next five years.

“Step-by-step improvements of manufacturing processes and efficiencies are leading to a gradual cost reduction for most of the back-contact technologies,” says Karl Melkonyan, senior research analyst at business intelligence company S&P Global Commodity Insights. “A significant cost reduction, however, will require more time to fully develop. This could be considerable reduction in silver consumption; or total replacement with copper or aluminum; or further improvements to soldering and cell interconnection processes, and other improvements in efficiency, yield, and throughput.”

Popular content

S&P Global forecasts back-contact solar could attain 15% market share over the next five years. InfoLink expects growth to around 5% over the next two years to three years but little after that. “For the long term, its market share is not likely to reach the scale of PERC or TOPCon due to its complex process and higher manufacturing costs,” says InfoLink’s Lin. “Although there’s still demand for back-contact – owing to its high efficiency and better appearance – its market share is not likely to reach 10%.”

Maxeon has been pursuing such manufacturing process improvements. “Maxeon has a completely proprietary process with a tremendous number of patents protecting the approach,” says David Smith, a scientist at Maxeon’s California R&D hub. “Processes that we have in pilot production today use much more mainstream equipment, so we can ride the coat tails of the TOPCon industry. We use these large-scale, high-throughput tools as much as possible and our new generation uses a higher fraction of those than ever.”

Saving and scaling

Maxeon, however, is still focused on customers who will pay a premium for performance and aesthetics, and says it will continue to focus on its differentiated products, even if more mainstream IBC technologies start to emerge.

ISC Konstanz believes the cost reductions needed to back its bullish IBC expectations can be met. The research center has developed “Zebra” IBC cells which are on the market via manufacturing partners in Europe and Asia, and continues to drive down production cost and raise efficiency.

“Our target is to be, from the cost structure point of view, as close as possible to standard technology,” says Joris Libal, ISC’s project manager for technology transfer. “We want to start with cheap processes, straight from the toolbox, and get to high efficiencies.”

Valentin Mihailetchi, group leader of n-type [negatively-doped] cell R&D at ISC Konstanz, goes on to explain Zebra cells are made using conventional processes including tube diffusion, screen printed metallization, plasma enchaced chemical vapor deposition, and laser ablation, adding, “It’s about using processes that are already established, just in a slightly different way.” That approach could bring wider benefits as back-contact architecture can be combined with passivating contacts and other cell designs, offering another route to mass production.

Silver consumption

Aside from the processing costs, IBC cells require silver contacts for both polarities. “Compared with p-type [positively-doped] PERC, there’s maybe 5% more cost for the wafer and a slight difference for equipment depreciation because there’s a little bit more equipment compared to PERC or TOPCon,” says Libal. “The main difference is the metal cost.”

With less need to make its rear-side fingers as thin as possible in back-contact cells, though, ISC Konstanz is using copper paste instead of silver in its screen-printing process. Conventional manufacturers, by contrast, need to make more progress on copper-plating processes to reduce silver content.

While ISC Konstanz’s IBC cells still require some silver for the contacts – the copper cannot be in direct contact with the silicon – Libal says silver consumption can be reduced below 5 mg/W of cell generation capacity. That is a fraction of the amount used in PERC and TOPCon cells and would help ease industry concerns about silver supply.

The research institute is moving ahead with its copper screen printing process and says it has achieved good results in accelerated testing thus far. “The Zebra IBC cell with copper metallization will be a breakthrough that will ultimately bring the cost of IBC down below PERC, with the efficiency still well above,” says Libal. “When these key parameters of cost and performance are met, that’s when this will really fly.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.