https://www.pv-magazine-australia.com/2022/09/10/weekend-read-teamwork-makes-the-green-work/

Weekend read: Teamwork makes the green work

The Red Lake Falls Project in northwestern Minnesota combines two 2.3 MW General Electric wind turbines with 1 MW of solar. Mike Bowman, the chief technology officer of GE’s Renewable Hybrids business, has described hybridity as “the next frontier in renewables.”

Image: GE

From ISSUE 09 – 2022.

In May 2018, India’s Ministry of New and Renewable Energy adopted the National Wind-Solar Hybrid Policy. Though paltry when it comes to offering incentives or preferential treatment to solar-wind-hybrid (SWH) projects, the policy aims to enable more SWH projects to efficiently utilise transmission infrastructure and land, as well as reducing variability in renewable generation and thus improving grid stability.

One of the many reasons India is so keen on SWH projects is their ability to mitigate renewable energy droughts when the wind doesn’t blow, or the sun doesn’t shine. According to a research paper titled “The role of wind-solar hybrid plants in mitigating renewable energy-droughts” published in Renewable Energy, SWHs offer genuine value. Anasuya Gangopadhyay, a researcher at the Indian Institute of Science’s Divecha Centre for Climate Change and co-author of the paper, told pv magazine the analysis shows “wind droughts are more intense than solar droughts in India. However, the amount of benefit [from SWH projects] varies from place to place and season to season.”

Comparing South India with Rajasthan in the country’s north, Gangopadhyay estimates that South India “experiences a negative correlation between daily wind and solar generation during the months of May to October, while Rajasthan has a positive correlation between these two variables during this period.” That is to say, windy days in hotter months are cloudier in South India and clearer in northern climes. “Solar wind hybridisation in South India helps us in utilising the benefits of that negative correlation, especially,” said Gangopadhyay.

Engineers at GE’s India Technology Center in Bangalore, southern India, noticed this problem as early as 2015, when Atria Power’s 25.6 MW wind farm in Borampalli generated 70% of its annual output in the monsoon season (April to August). When the pricing model took power settlements to a monthly rather than annual basis, this seasonality became problematic. That was, until they remembered Borampalli receives 10 hours of sunlight daily in the dry season (February). As Atria COO Anand Lahoti put it, “we realised that if we put together wind and solar power, the two energy sources can be very complementary.”

The same solution is also being sought to northern seasonality in India. After commissioning a 390 MW SWH in Rajasthan in May, Adani Green Energy CEO Vneet S. Jaain said that “wind-solar hybrid energy is an important aspect of our business strategy, which aims to meet India’s growing need for green energy.”

Bridge to India’s (BTI) managing director, Vinay Rustagi, said that SWHs “are becoming increasingly popular due to their smoother power output profile. We are seeing a trend in India where the utilities and even large corporate consumers are preferring SWH over plain solar projects despite higher cost.”

Rustagi estimates about 3.1 GW of SWH projects are already operational and counts 17 tenders issued so far for SWH projects in India, totalling 16.2 GW of capacity, of which 11.5 GW has been allocated post auctions. Rustagi said “actual project capacity would be about 50% higher due to oversizing of solar and wind capacity in such projects. Going forward we expect more than half of all renewable capacity to be tendered and executed in the form of hybrid projects.”

In August, Indian developer ReNew Power secured a $1 billion loan for a 1.3 GW hybrid wind-solar project that will see 900 MW of wind and 400 MW of solar spread across the Indian states of Karnataka, Rajasthan, and Maharashtra. According to BTI, generally SWH systems aren’t co-located, but rather separate projects which pool their power at the same, or sometimes different, substations.

European potential

Another land-conscious and grid-congested region where SWHs are becoming increasingly attractive is Europe. Spain, a country particularly concerned about growing renewables cannibalisation, is among those leading the push. Global head of project finance at Banco Sabadell, Roger Font, told pv magazine that the major saving for SWHs is provided by the shared grid connection.

“You save investment capex,” said Font, noting that the savings come on top of the reduced risk of curtailment provided by a smoother generation profile. “From talking to our technical advisers, it makes a lot of sense. You might lose 5% to 10% PV production due to technology overlap, but you save 20% on capex. The only issue is that you need to look plant by plant to see how the wind profile matches to PV.”

Font noted that a lot of the sponsors in Spain are interested in hybridisation. “They have big plans. One large sponsor told me all of their projects would be hybrids,” he said.

For this reason, Banco Sabadell has already financed projects with an additional facility, non-committed, which allows excess depth for hybridisation.

This economic case currently makes SWHs easier to finance than the hybridisation of PV plants with a battery energy storage system (BESS), not simply due to the initial expense, but rather the lack of established markets in Spain to recoup the BESS investment. “It’s very difficult to finance batteries nowadays, because in Spain you don’t yet have capacity payments or payments for services,” said Font.

He noted that the policy backlog facing storage hybrids is more complex than the licensing backlog faced by SWH projects, caused by institution overload.

While the Spanish authorities are very excited about SWHs, Font said “it is very difficult for them to process as many applications as there are, but otherwise they’re very interested in anything that can give reliability.”

This is also why existing wind projects are considering retrofitting their plants with solar. Banco Sabadell is involved in the financing of several solar retrofitting projects in the next year or two.

Further north, in Denmark, the retrofitting has already begun. In May, Danish renewables company Eurowind Energy inaugurated two SWH plants and announced plans in July that it would be hybridising at least five of its onshore wind plants to create “energy centres.” This includes the 26-turbine Energipark Overgaard site, where a planning application has already been lodged for 700 hectares of land to host solar panels, enough space to host more than 600 MW.

According to Eurowind Energy’s head of public affairs, Joachim Steenstrup, the company’s latest greenfield wind farms of Veddum Kær Energypark and the St. Soels Energypark include 15 MW and 19 MWac of solar, respectively. Both are co-located systems, and Steenstrup said the company is already working to retrofit its other wind sites because it’s easier to put solar up with existing turbines than it is to put turbines up with existing solar.

“In Denmark the wind doesn’t blow in July,” said Steenstrup. “But in January there isn’t much sunshine. They complement each other excellently. If we had 100 MW of wind and 100 MW of solar sharing the same 100 MW grid connection, the loss would only be 8% (periods of overlapping generation), and if you look at how valuable that 8% is, it’s worth next to nothing, because both wind and solar would be active and so power prices would be through the floor.”

From the start of 2023 the Danish state will no longer cover the cost of grid connection for renewable energy producers, meaning SWHs are suddenly a hot ticket. “What we’re looking for in combining these two is basically getting a lot of full-load hours and getting more bang for our buck,” said Steenstrup. “Generally, in Denmark, with trackers and bifacial you can do around 1,300 full-load hours, a decent wind site might accrue 3,500, so together you can probably reach 4,700 full-load hours, and that makes a difference when you calculate the cost of a grid-connection.”

Eurowind is an active wind generator in 14 markets across Europe and in the US, and plans to hybridise systems in the markets where it makes sense. “Germany would be interesting – Romania, Portugal, Spain and Italy as well,” said Steenstrup. “And definitely in the US. Hybridisation is especially interesting in California where they have daily volatile prices.”

US situation

The cost-effectiveness of SWHs is not felt solely in the back pocket of developers. According to Jennifer King, a researcher at the National Renewable Energy Laboratory (NREL) who recently co-authored a paper in Wind Energy Science Discussions titled “A Simplified, Efficient Approach to Hybrid Wind and Solar Plant Site Optimisation,” SWH systems are effective tools for avoiding transmission congestion.

“We probably won’t be able to build transmission fast enough to reach our decarbonisation goals in time,” said King. “Hybrids can help because it provides a cost-effective (enough) way to build in sub-optimal resource areas but at least where there is existing transmission and avoided grid congestion.”

As King told pv magazine, “no one wins when renewables are curtailed.” Hybrids not only allow developers to maximise their grid connection, but allow increased flow of renewables closer to where said energy is being consumed – the key to efficiency and grid stability.

Ultimately, King said, “the limitations of the transmission system are really driving hybrids. If the transmission system was built out perfectly, we would not need hybrids.”

Hence also why there’s not just a push for greenfield hybrid projects, but also for the retrofitting of existing wind farms, as is being seen in Denmark.

“There is a new push for ‘solar under wind’, meaning adding solar to wind at an existing interconnection point rather than waiting in the queue,” said King. “Waiting for an interconnection point is the real problem. If the wind plant is not using the interconnection point fully during the day due to low or no wind, you might as well build solar to fill up the extra capacity.”

As far as King is concerned, such hybrids will become the new norm for renewable energy projects.

Both King and Eurowind’s Steenstrup told pv magazine that hybrid plants adding a Power-to-X system as an “end product” is a new consideration. This could include using energy that would otherwise be curtailed to make hydrogen or other e-fuels, heat, and so on.

Moving offshore

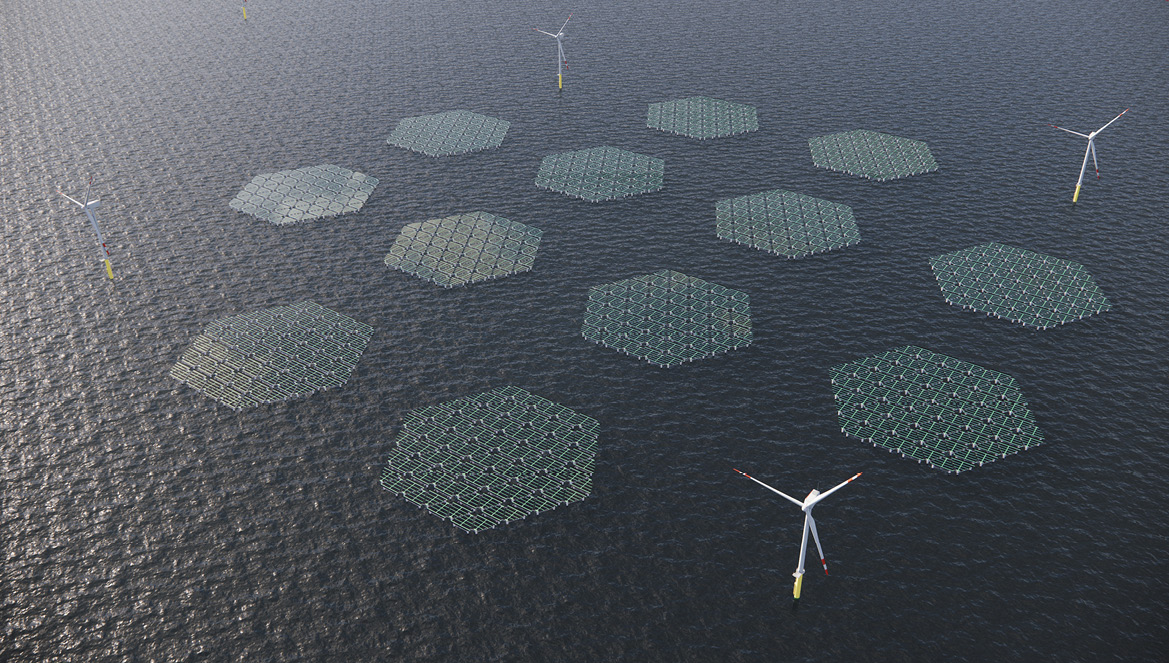

One area set to see SWH projects sooner rather than later is offshore. Norwegian floating PV (FPV) developer Ocean Sun recently signed a technology licence agreement with Chinese state-owned State Power Investment Corporation (SPIC) for a 0.5 MWp offshore pilot project in Haiyang, China. The license will see the 0.5 MWp FPV pilot connected to a wind turbine off the coast of Shandong Province.

Ocean Sun CEO Børge Bjørneklett said that in countries like China and the Netherlands, which have a high population density combined with land scarcity, FPV systems can not only share the same grid connection, but “are better in the sense that they don’t occupy huge land area in competition with urbanisation or agriculture.”

Bjørneklett added that offshore SWH projects represent new possibilities for FPV, but noted that “wind farms are often located in regions where you also have relatively big waves. The challenge for FPV designers is to construct a system with reasonable capex for the floater structure and mooring.”

Meanwhile, Dutch-Norwegian FPV company SolarDuck recently signed a collaboration agreement with RWE to accelerate SolarDuck’s offshore FPV technology with the aim to hybridise RWE’s offshore wind farm Hollandse Kust West (HKW) with 5 MW of FPV. That amount of capacity would require six of SolarDuck’s triangular FPV platforms.

But first SolarDuck needs to deploy its full-scale 0.5 MWp offshore pilot in the North Sea. SolarDuck co-founder Olaf de Swart told pv magazine the goal of the “Merganser” pilot is to have it installed before the winter season ends with the hope of catching one of the winter storms in the process. “The final proof will be when a storm hits and we can see the behaviour of our system in practice.”

For obvious reasons, the costs of a new grid connection increases dramatically as soon as you head offshore, so FPV additions to existing wind farms and already established connections have enormous potential. De Swart believes FPV can “piggyback” on the offshore wind industry to allow offshore solar to adapt much faster.

“Offshore solar energy has a higher energy density compared to offshore wind and therefore could provide a huge contribution to the energy production,” continued de Swart. “The offshore wind hybrid market is one of the ideal markets for offshore solar to reach adoption rapidly. But in other geographies, specifically in the sunbelt, with less wind and more sun, the standalone offshore PV market may dominate.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

<