German PV installers have told pv magazine that consolidation is already underway in the residential sector.

“Consolidation is in full swing and I'm excited to see who will still be there at the end of the year,” said one managing director, on condition of anonymity.

Installers face significant challenges, including employee utilization, short waiting times for commissioning, and declining demand due to higher interest rates, inflation, and high electricity prices.

“There is an urgent need for additional incentives,” said another managing director. He warned that the PV market could face consolidation and price wars. He also said that large online providers could exploit current market conditions, affecting even reputable solar installers.

Sources point a 60% drop in demand for residential systems compared to last year, with order intake down by 45%. The demand decline for PV systems between 30 kW and 100 kW is less severe, however. “Several competitors in our region are already insolvent, but this is a healthy market shakeout,” said one executive.

The rise of PV balcony systems has also contributed to the stagnation of rooftop system demand. “Price competition in the balcony module segment makes a normal PV system seem too expensive,” said another executive.

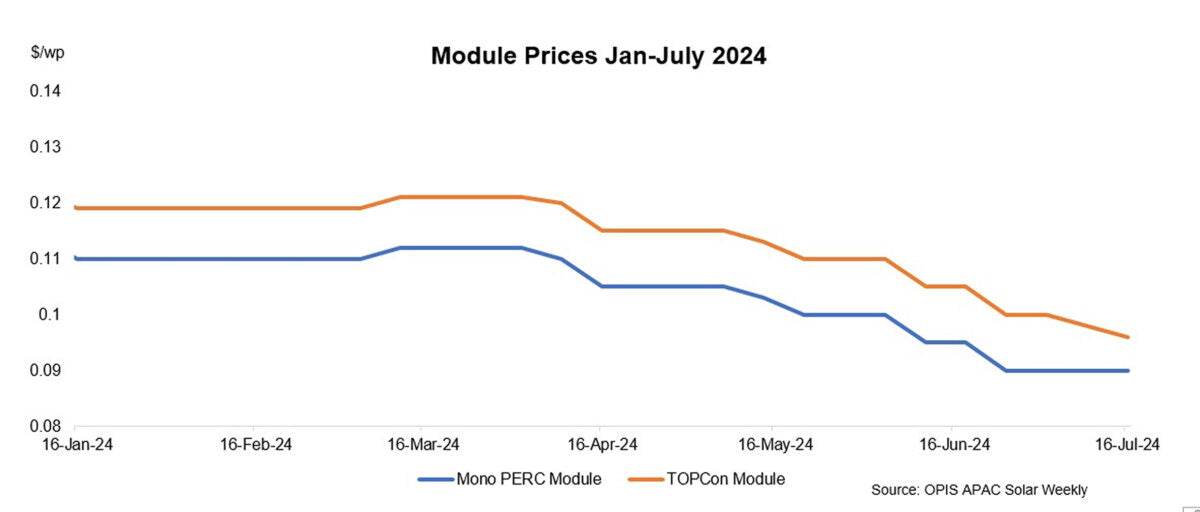

Another long-standing installer compared the current market to 2012, criticizing the media's focus on low prices from third-rate Chinese manufacturers. Such prices are only feasible if quality suffers, said the executive.

One northern German installer noted issues with “dumping prices” from companies with excess stock. “I’m pessimistic about the second half of the year,” he said, noting the need for future support and policies to ensure sector stability.