https://pv-magazine-usa.com/2023/12/21/sunpower-breaches-credit-agreement-warns-business-may-go-under/

SunPower breaches credit agreement, warns business may go under

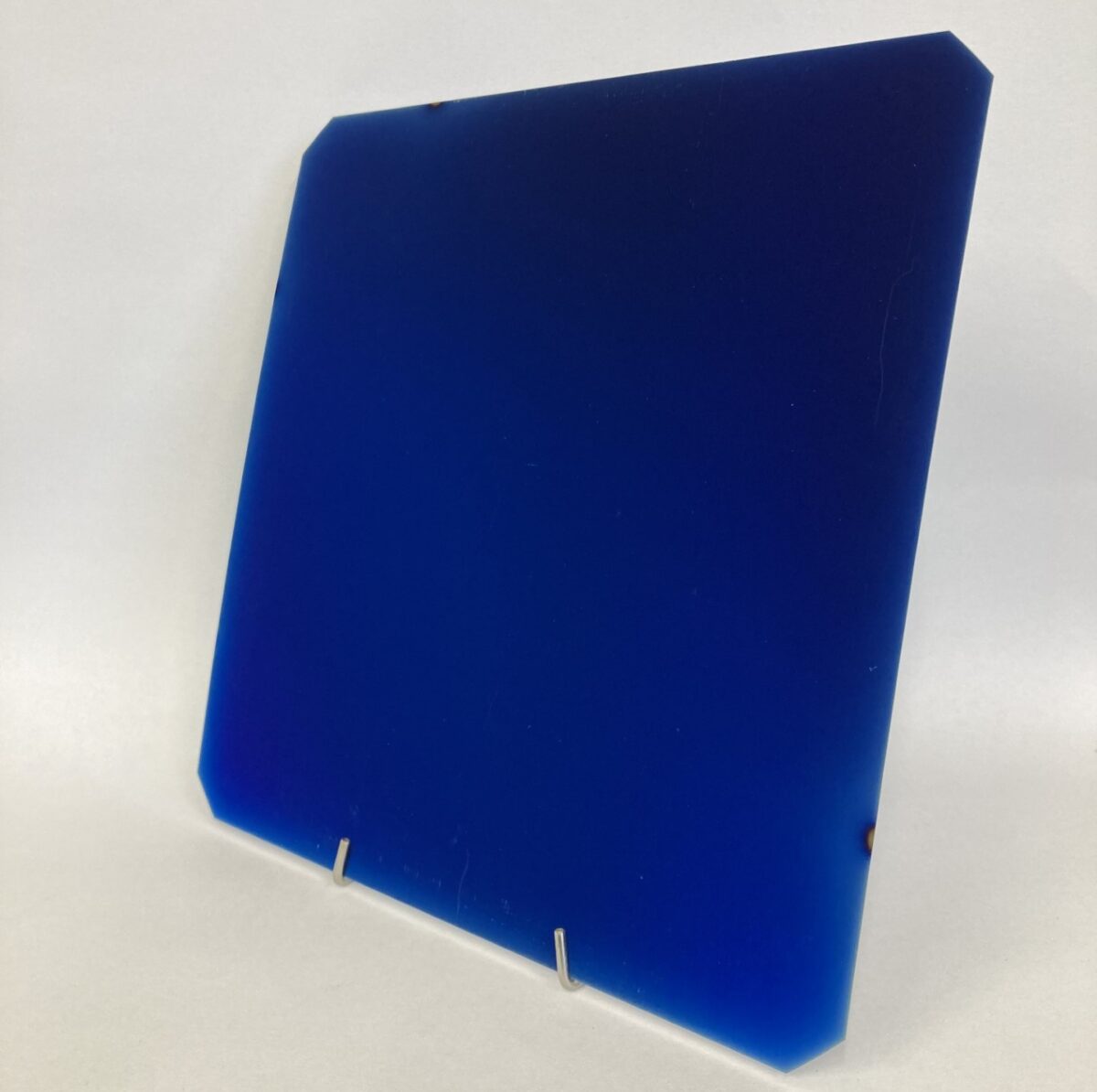

Image: SunPower

Residential solar company SunPower suffered a drop of over 40% in share price this week as it filed a quarterly earnings report that flagged a “going concern.”

The concern was sparked by a technical default on debts owed by the company. In October, SunPower announced it would re-state third quarter financial results due to an inventory reporting error with one of its subsidiaries. Being late with financial reporting placed SunPower in breach of key terms in several credit agreements, leaving the company exposed to lenders’ requests for immediate repayment.

In all, SunPower stated that this breach could lead to lenders demanding immediate payment of over $65 million in debt, causing the company to express doubts about its ability to keep its operations running.

The company said it is currently trying to secure a waiver with the lenders, and without one, it may lack funds to support day-to-day operations.

On Dec. 8, 2023, the company received a similar waiver that saved it from technical default and provided it access to $75 million in funding. SunPower has until January 19 to shore up finances or receive another waiver for the some $65 million in debt it is obligated to repay.

Pavel Molchanov, an analyst at Raymond James, told Reuters that the company stands a good chance to secure a waiver, as it essentially resulted from a technical issue.

Roth Capital Partners said in an industry note that if SunPower fails to secure the waiver, it could lead to a “cascade” of cash flow challenges, leading to cash flow constraints for SunPower dealers.

The company has posted over $110 million in operational losses through three quarters this year. Residential solar has struggled industrywide in the U.S. in 2023 due to the macroeconomic environment and critical policy changes.

High interest rates in particular have been a detriment to companies like SunPower, who rely on lending to offer their customers attractive long-term solar energy contracts.

Looking ahead

While hard times have hit U.S. residential solar, Enphase co-founder Raghu Belur told pv magazine USA he believes 2024 will be “a year of recovery” for the industry.

Belur pointed to the financial fundamentals of rooftop solar, storage and EV charging. Interest rates are eventually going to come down, and meanwhile, utility rates are rising far faster than inflation. This is particularly true in California, where the Public Utilities Commission approved a 13% bump to electric utility rates in 2024. Couple these changing forces with diving solar module prices, and suddenly the payback period looks strong, and demand recovers.

While solar and storage shoppers typically use a rule of thumb of about 3% to 4% annual rate increases from the utility company to estimate long-term savings, Belur said this assumption no longer applies. “Double-digit rate hikes are common now,” he said.

Belur recognized that it has been a difficult year for rooftop solar, but said he remains confident that financial fundamentals will win back customer demand. Under California’s NEM 3.0 policy, what used to be a four-to-five-year payback period, or return on investment, for rooftop solar, is now about seven to nine years.

“But you’re buying a 25-year asset, so you’re still coming out way ahead,” he said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.