https://www.pv-magazine-australia.com/2022/08/27/weekend-read-strong-case-for-energy-storage-despite-rising-costs/

Weekend read: Strong case for energy storage, despite rising costs

Source: IHS Markit

From pv magazine 08/2022

The cathode is the biggest contributor to the cost of a lithium ion (Li-ion) cell, typically accounting for 30-40% of the total, depending on the type. Cathodes are made of a variety of materials, such as lithium, nickel, cobalt, and aluminium. Along with other materials like graphite and copper, these are all used extensively in batteries and have experienced significant price increases. Lithium has seen a particularly dramatic rise – increasing nearly six-fold between Q2 2021 and Q2 2022.

As a result, cathode costs for all major types Li-ion batteries have roughly doubled in the last year. This has been a major driver in battery cell costs rising in 2021 and 2022. For example, the average cost of an LFP (Lithium iron phosphate) cell is now 20% higher than it was in 2020. The price of battery modules for use in energy storage systems has risen around 30% over the last two years. Paired with increases in the cost for transportation, logistics, and supply chain challenges, this has resulted in the total capital cost of a battery storage system rising by about 15% in the last year.

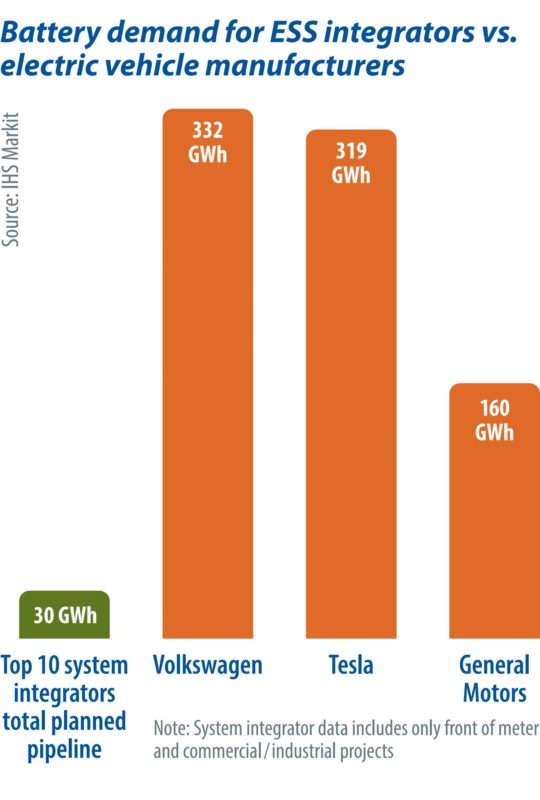

Additionally, the battery energy storage industry continues to see shortages in the supply of Li-ion batteries due its relatively insignificant size compared to the electric vehicle (EV) industry. For example, IHS Markit estimates that the combined pipeline of the 10 largest energy storage system integrators is equal to less than 10% of the batteries that Volkswagen is expected to buy in the next three years. This is particularly a problem for LFP, which the stationary storage industry favours due to its lower cost and higher safety.

EV makers have historically embraced higher energy density nickel-based cathode technology, and these cathode types accounted for 93% of batteries consumed by the electric car sector in 2019 and 2020. However, today, EV makers are increasingly announcing models that will utilise LFP technology, trading longer ranges for lower costs. For example, Tesla announced in late 2021 that it would begin offering its LFP-powered “standard range” models globally rather than only in China. They have proved very popular, and the EV manufacturer publicly announced that nearly half of vehicles sold in Q1 2022 used LFP technology.

While increases alone are a challenge, visibility on future prices is also unclear. Battery manufacturers are increasingly offering supply agreements with variable prices that are indexed against raw material costs, leaving energy storage system integrators exposed to volatile commodity prices, and with a lack of visibility on the total costs until shortly before purchase. This adds risk to financiers and owners that need to plan years in advance to find a profitable business case.

Shifting fundamentals

Although system CAPEX has increased, highly volatile electricity prices (which create stronger arbitrage opportunities for batteries), surging home energy costs (which make residential solar and storage more attractive), and an increased push for renewables to reduce reliance on fossil fuels (e.g., the European Commission’s REPowerEU strategy) all strengthen the business case for storage, even at higher prices.

For example, net day-ahead wholesale arbitrage revenues in Europe for battery energy storage in January 2022 were two to three-times higher than just one year previously. Additionally, between 2021 and 2022, retail electricity price increases have halved the payback period of solar-plus-storage in the residential sector in many European markets. However, even if developers go ahead with projects at higher capital cost, supply chain challenges may still cause delays.

When will prices fall?

While there are no immediate signs of these challenges easing, IHS Markit sees two important factors that will help to alleviate battery supply constraints for the energy storage sector. The first will be a continued scale-up of LFP battery manufacturing. Battery costs are dependent on economies of scale, with high volume manufacturing key to driving down costs. This is particularly the case for LFP, as manufacturing costs (as opposed to material costs) account for a greater share.

Global LFP capacity is predicted to continue rising. Announced expansion plans currently suggest it will reach 330 GWh of annual capacity in 2025, compared with less than 200 GWh in 2020. In reality, capacity may reach much higher than this, as new expansions will be announced in reaction to increased demand.

The second will be a validation of an emerging second tier of Chinese LFP manufacturers. The S&P Global Commodity Insights Battery Cell Manufacturer Database records 40 LFP manufacturers, all located in China, with the five largest accounting for half of their combined total manufacturing capacity.

Although the largest and most reputable of these manufacturers are now heavily engaged in supplying their batteries to large automotive OEMs, the majority are tier 2 manufacturers without the required scale and bankability to serve this customer base. These companies will have sufficient capacity to serve the energy storage industry. Energy storage system integrators are looking to form partnerships with these companies, and if the quality and reliability of their batteries can be validated to the extent they are considered bankable, a group of specialised energy storage battery manufacturers is likely to emerge, alleviating supply constraints.

While these factors will help ease the short supply of battery cells and modules, the industry as a whole remains at the mercy of the upstream supply chain’s ability to scale up and deliver the raw materials required. Capacity expansion plans are in place, underpinned by substantial investments in the area, but periods of tight supply are inevitable given that robust demand growth is predicted each year for the foreseeable future.

“ The combined pipeline of the 10 largest energy storage system integrators is equal to less than 10% of the batteries that Volkswagen is expected to buy in the next three years”

About the authors

Sam Wilkinson is a director within the Clean Energy Technology research team at IHS Markit, now part of S&P Global, responsible for the company’s research of battery and energy storage markets. Before establishing IHS Markit coverage of the energy storage industry in 2012, Wilkinson focused on the solar PV market and has now amassed more than a decade of experience across these sectors. Wilkinson holds a bachelor’s degree in math and engineering from the University of Nottingham, United Kingdom, and previously worked in structural engineering.

Oliver Forsyth is a research analyst with the Climate and Sustainability team at IHS Markit. Forsyth provides strategic research on energy storage in markets across Europe, Australia, and Asia Pacific, focusing on revenue stream analysis, the competitive landscape, and regulatory change. Prior to joining IHS Markit, he was a research analyst with The Faraday Grid, an energy technology startup based in Edinburgh, United Kingdom. Forsyth holds a Master of Arts in economics with management science from the University of Edinburgh, United Kingdom.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

<