https://www.pv-magazine-australia.com/2024/06/15/weekend-read-southeast-asian-solars-bright-future/

Southeast Asian solar’s bright future

Image: Afry

From pv magazine print edition 6/24

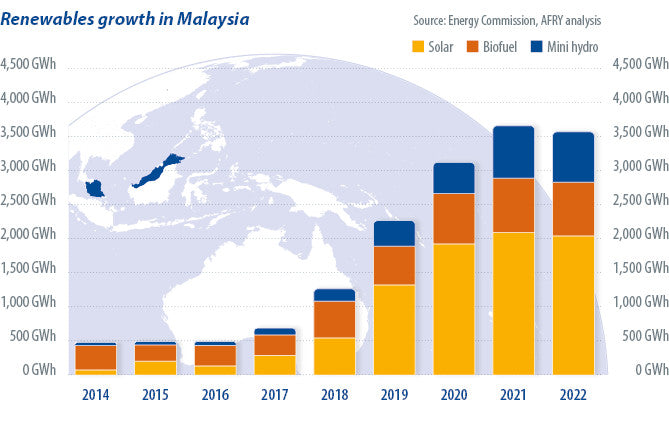

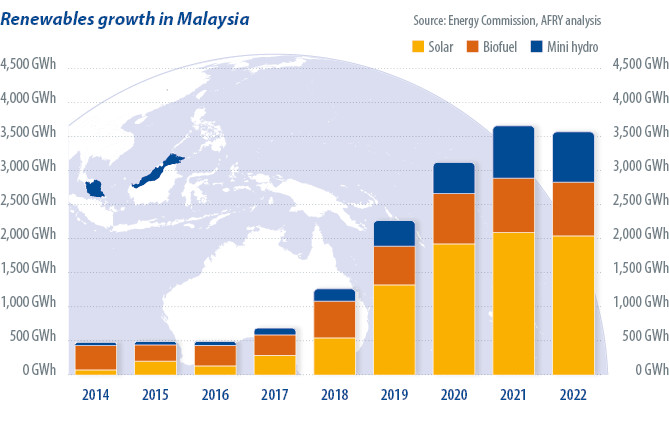

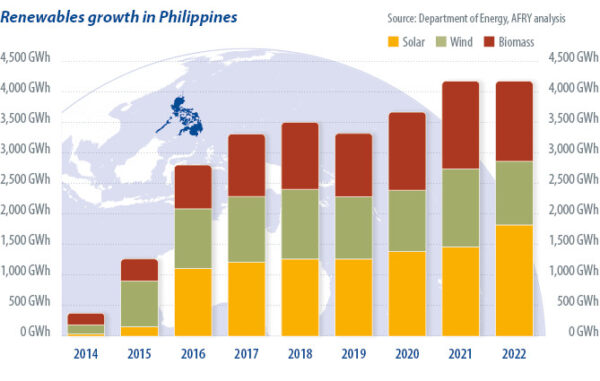

Achieving the Association of Southeast Asian Nations’ (ASEAN) aim of having 35% of its energy mix comprise renewable energy capacity by 2025 will require substantial effort. Renewables growth in Malaysia and the Philippines helped ASEAN to reach 32% at the end of 2023 and continued development in both countries will be crucial for the region to meet and exceed its goals.

Malaysian PV

A feed-in tariff (FIT), introduced in 2011, spurred Malaysian solar forward. Large-scale solar (LSS) auctions and net-energy metering programs were introduced in 2016. The auctions have thus far produced committed solar generation capacity of 2.2 GW, anticipated to be fully operational by the end of 2024.

Meanwhile, net-energy metering has driven a cumulative 1.5 GW of rooftop solar capacity, which is expected to be online by 2025.

The chart above shows the growth of operational renewables capacity, with high solar growth starting in 2018, driven by the auction program.

Philippines’ FIT

Solar was first added to the Philippines grid in 2005 but only started to grow substantially in the mid-2010s, driven by the FIT, which began in 2013 and resulted in a burst of renewables projects, including solar. The FIT rates were 20-year fixed prices well above standard prices for power supply agreements or on the wholesale electricity spot market at the time.

The chart below shows the evolution of renewables generation from 2014 to 2022. The Green Energy Option Program (GEOP), which started in early 2022, allows eligible end users, including those with average peak demand of more than 100 kW – lower than the contestability threshold of 500 kW – to source their own supply from renewable energy resources, further driving solar capacity.

Path forward

Malaysia’s target of 40% renewables by 2035 requires more than 7 GW of installed solar capacity by that time.

In 2024, Malaysia announced the opening of the fifth LSS auction, offering 2 GW. Malaysia also initiated the Corporate Green Power Programme (CGPP) in 2022. To date, nearly 600 MW of generation capacity has been secured. The CGPP enables corporate consumers to virtually purchase solar energy directly from developers. To ensure grid stability, the government initiated a 400 MWh pilot project for battery energy storage systems (BESS). It will function as a pathfinder to enable Malaysia to formulate the right frameworks, both technically and commercially, for BESS to complement solar growth.

Based on ongoing discussion with local stakeholders, future LSS auctions in Malaysia may include some BESS requirement.

For the Philippines, achieving the government’s targets of 35% renewables by 2030, and 50% by 2040, requires a lot of development.

The Department of Energy’s (DOE) Green Energy Auction Program (GEAP) provides an alternative market option for renewables developers while also ensuring that clean energy costs are not excessive. The first auction, held in 2022, was a success. Target capacity for renewables was set at 2 GW and almost all that capacity was awarded.

Meanwhile, awarded capacity for the second auction was only 3.4 GW – barely 30% of the 11.6 GW overall target. Developers cited unacceptably low price caps, long lead times for system impact studies, and grid connection issues as the main deterrents.

There are ambitious projects outside of the GEAP. At 1.3 GW, the floating solar project that is set to be developed in Laguna Lake is one of the largest of its kind in the world. Meanwhile, developers are increasingly building projects that feature energy storage, sometimes alongside solar, to provide firm load for energy contracts, ancillary grid-supporting services (for standalone battery storage), and energy arbitrage – storing electricity when cheap to sell during peak periods. Evaluating the “revenue-stacking” economics of such systems can be challenging, however.

The future of solar in Malaysia and the Philippines is bright, but uncertainties still persist.

About the authors: Ibrahim Ariffin is a manager for Afry Management Consulting’s energy sector and has more than 15 years’ experience working in sustainable energy and related fields. He specializes in strategy development and policy advisory, particularly in connection with the Malaysian electricity supply industry.

About the authors: Ibrahim Ariffin is a manager for Afry Management Consulting’s energy sector and has more than 15 years’ experience working in sustainable energy and related fields. He specializes in strategy development and policy advisory, particularly in connection with the Malaysian electricity supply industry.

JP Grayda is a senior consultant at Afry’s energy sector and has more than a decade of experience in electricity market design and operations. He previously worked for the wholesale electricity market operator in the Philippines, holding roles focusing on market analysis, simulations, and studies. He leads modeling of the nation’s power market.

JP Grayda is a senior consultant at Afry’s energy sector and has more than a decade of experience in electricity market design and operations. He previously worked for the wholesale electricity market operator in the Philippines, holding roles focusing on market analysis, simulations, and studies. He leads modeling of the nation’s power market.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

<