https://www.pv-magazine.com/2023/12/16/weekend-read-famine-to-feast-chinas-solar-market-in-2023/

Famine to feast – China’s solar market in 2023

China plans to use big PV projects, like the Dalat array in the Kubuqi Desert, to control sand and wind, limiting desertification in various regions.

Photo: Huawei

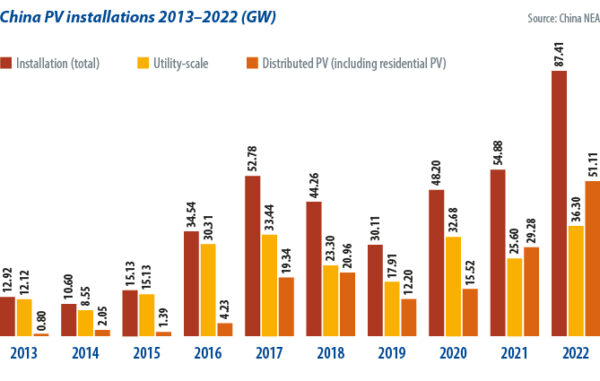

National Energy Administration (NEA) data indicate China is likely to have added more than 180 GW of solar generation capacity in 2023 and could top 200 GW, as it hit almost 143 GW of solar at the end of October 2023. Those numbers would represent year-on-year growth of 106% to 129% on 2022 and would eclipse all the solar added from 2020 to 2022.

When Wang Bohua, honorary secretary of trade body the China PV Industry Association (CPIA), addressed a PV conference in early 2023, he projected installations of 95 GW to 120 GW for 2023. Downstream solar investment exploded, however, driving a surge in utility-scale, residential, and commercial and industrial (C&I) installations. At the SNEC PV exhibition in Shanghai in May, executives from tier one and tier two module manufacturers told pv magazine their annual installation estimates had risen to 160 GW-plus.

The CPIA revised its number to 120 GW to 140 GW in July. S&P Global and the China Electricity Council, a government agency, raised their estimates to 170 GW in October. In November, market research firm Trend Force projected 194 GW to 210 GW of new solar in China in 2023.

Emboldened by China’s “30-60” goal of reaching peak emissions by 2030 and net zero by 2060, the nation’s energy-related state-owned enterprises (SOEs) have pledged 350 GW of solar generation capacity. In the first half of 2023, companies signed more than 80 GW of utility scale solar investment deals. Some 61.8 GW was connected by the end of September 2023.

The pandemic disrupted the installation of smaller, “distributed” solar arrays until late 2022 but China rebounded to install 34.1 GW of distributed commercial and industrial (C&I) systems by the end of September 2023. Residential-solar policy, cheaper new products, and rising demand drove 33 GW of home solar capacity by the end of September 2023, a 30.5% rise on the total figure for 2022, as more than 1.5 million new customers chose to “go solar.”

Panel prices

These numbers have risen on the back of two years of falling panel prices that have supercharged solar plant development. A polysilicon price surge in 2022, from CNY 80 ($11.24)/kg to CNY 300/kg ramped panel prices to CNY 2/W of generation capacity, with solar glass costs having also surged in 2021 and 2022.

Vast expansion in solar production capacity since late 2022, however, has seen panel prices come to around CNY 1.9/W in January 2023, less than CNY 1.7/W in March 2023, and CNY 1.3/W in offers submitted for project tenders by tier one module makers in July 2023. A price of CNY 1.18/W was bid for one SOE-led procurement exercise in July 2023. A November 2023 procurement by State Power Investment Corp. and state utility China Huadian Corp. attracted a CNY 1.01/W bid for JinkoSolar’s negatively-doped, “n-type” panels and some passivated emitter rear contact (PERC) products bid at CNY 1/W, for a more-than-45% price fall during 2023.

Analysts estimate a CNY 1/W to CNY 1.1/W cost threshold for tier one module manufacturers. Liu Yuxi, president of Longi Green Energy’s China regional department, recently told a conference that “if the PV panel price falls below CNY 1/W, it signifies a complete dip below the cost threshold.”

Overcapacity

The current overcapacity in Chinese solar production is down to the government’s 30-60 carbon commitments, with big players expanding in anticipation of future market growth.

An estimated CNY 2.5 trillion worth of solar production expansion plans have been announced since 2020, with CNY 700 billion of commitments in 2021 and CNY 900 billion in 2022. While the investment boom cooled considerably in 2023, eight leading PV companies recently announced CNY 300 billion of production investment. Polysilicon production secured more than CNY 700 billion of investment from 2020 to 2022 and solar ingot and wafer manufacturing snagged more than CNY 290 billion. Cell and panel production investment topped CNY 820 billion during that period while solar glass attracted CNY 110 billion; ethylene vinyl acetate and polyolefin film production CNY 18.5 billion; diamond wire cutting equipment CNY 14 billion; and backsheet production CNY 20 billion.

Data from the CPIA and the silicon branch of the China Nonferrous Metals Industry Association indicate China will reach three million tons of annual polysilicon production capacity during 2023, plus 800 GW of solar wafer lines, 700 GW of cell capacity, and 800 GW of module fabs. Oversupply means factory utilization rates are likely to be lower than for 2022, however.

A divergence in opinion between corporations and the government is evident regarding overcapacity. Longi’s Liu believes the current overcapacity has started to impede the innovation capability of Chinese PV enterprises. That is primarily due to the lower selling prices resulting from overcapacity, which in turn hamper profitability and the corporate funds available for research and development.

On the other hand, Liu Yiyang, deputy secretary general of the CPIA, holds the belief that overcapacity is an inevitable occurrence in a market economy. He said that the issue lies in the structural aspect of overcapacity and argued that it is crucial to acknowledge that a market economy inherently experiences overcapacity, due to competition.

An official from China’s Ministry of Industry and Information Technology said that the Chinese PV industry is operating within a normal scale. The official said that overcapacity is a regular phenomenon in market competition.

The stock market has provided a stern response to both viewpoints. China’s PV stock prices have consistently declined during 2023, with many leading solar companies experiencing share price falls of 50% or more. That decline indicates that investors have deep concerns about the industry’s profitability.

New technology

Enormous investment has been allocated not only to expand production capacity but also to fuel research and development efforts and promote new technology. Throughout 2023, a plethora of new technology has been integrated into production processes.

Polysilicon manufacturer GCL, for instance, has made substantial investment in the expansion of its granular silicon production capacity, hailing its product as second-generation polysilicon, with superior cost-effectiveness and consistency. Lan Tianshi, joint chief executive officer of GCL Technology, told the media that the cost of granular polysilicon produced at GCL’s Leshan factory is below CNY 36/kg. That significant cost advantage positions GCL as an unrivaled contender in the polysilicon price war.

Exorbitant polysilicon prices in 2022 prompted wafer companies to explore various methods of wafer thinning and material-cost reduction. Companies such as Longi, TCL Zhonghuan, and Gaoce have achieved remarkable success in thinning silicon wafers to less than 150 micrometers for tunnel oxide passivated contact (TOPCon) solar cells, with even thinner wafers, with a thickness of 90 micrometers to 100 micrometers for heterojunction (HJT) devices. Those advancements have significantly diminished polysilicon input costs.

Cell savings

The most notable strides in technological advancement have been witnessed in the field of solar cells. As the efficiency of PERC cells nears its theoretical limit, manufacturers have shifted their focus toward the next generation of cell technology. Differing perceptions about technology and the market have led to divergent choices among manufacturers.

Leading panel makers such as JinkoSolar have gravitated toward TOPCon technology, which allows for seamless upgrades from their extensive PERC production lines. Jinko recently said that its TOPCon production capacity had reached an impressive 55 GW by the end of June 2023, with expectations that its n-type TOPCon production capacity will account for more than 75% of its total 110 GW module capacity by the close of 2023.

This rapid upgrading of production lines is contingent upon the market’s swift acceptance of n-type TOPCon products. In the first half of the year, Jinko’s n-type products already constituted more than half of its total 30.8 GW of module shipments and it is projected that n-type products will make up over 60% of its annual shipments for 2023.

Popular content

HJT technology is also experiencing rapid market penetration. Huasun, a new player in the panel industry, anticipates reaching 15 GW of both HJT cell and module capacity by the end of 2023, with plans for an additional 20 GW of new capacity.

Leading panel manufacturer Risen is also placing its bets on HJT, aiming for 15 GW of cell and module capacity by the end of 2023. When combined with other companies investing in HJT, a cumulative panel production capacity of almost 70 GW could be put into production by the close of 2023. This suggests that a substantial quantity of HJT modules will be delivered to the market in 2024.

Longi and Aiko Solar are actively promoting different types of back-contact (xBC) cell technology, with Longi presenting its hybrid passivated back contact solution and Aiko focused on an all-back-contact approach. Given the industry prominence of both companies, xBC cell technology is poised to evolve significantly in 2024. The combination of TOPCon, HJT, and xBC cells is driving the replacement of PERC technology, accelerating its exit from the market.

In a significant development, the majority of prominent Chinese panel manufacturers convened in June to establish a standardized dimension for medium-format PV panels, ending the practice of individualized sizes. Unified panel dimensions not only streamline transportation and warehousing processes but also contribute to cost reduction within the industry.

New scenarios

In China, utility-scale PV is primarily led by state-owned energy companies. Limited land availability in eastern and southern China ensures large-scale power plants are predominantly located in highland desert areas in northern and northwestern regions. Sites face power consumption challenges, however.

To address this, the Chinese government plans to construct ultra-high-voltage transmission lines to transport the power generated to economically developed regions in the middle and east of the country.

As part of its 14th national five-year plan, China aims to establish large renewable energy bases in nine regions across its western, northern, and northwestern regions by 2030. The target is to install a minimum of 450 GW of renewable energy generation capacity, primarily consisting of solar and wind sites. In 2021, state-owned energy companies initiated the first batch of projects, with a total generation capacity of 97 GW. The second batch, expected to exceed 400 GW, will commence construction after 2023. It is anticipated that around 100 GW of projects will be completed within the 14th five-year plan period, which closes in 2025.

These large-scale energy bases, guided by the National Development and Reform Commission and the NEA, have multiple roles. Apart from accommodating high-capacity renewable energy installations for clean power generation, they also serve as testing grounds for new module products.

The approach resembles the government’s previous Top Runner Program but the new utility-scale energy bases could also test generation measurement and energy storage approaches for grid power peak shaving, green hydrogen production, desertification control, agrivoltaics, “PV pastures,” and even “advanced coal power facilities” to enhance power quality.

In addition to the development of the energy bases, state-owned energy companies have discovered new applications for solar technology, namely highway and offshore PV.

Novel applications

The implementation of highway PV involves installing distributed PV power farms on the roofs of buildings within highway service areas, parking lots, and along the roadbeds adjacent to service areas. These power generation systems can supply clean electricity to serve passengers and vehicles. Some state bodies have even explored installing PV systems in the middle of the highway isolation zone and on both sides of soundproofing walls. Technical and cost challenges remain, however. Several local governments have initiated studies and the formulation of technical specifications and supportive policy. The future of highway solar holds great potential and is expected to gain traction.

Offshore floating PV is also on the rise. According to data from the China Ministry of Natural Resources, the nation boasts a vast expanse of approximately 710,000 km2 that is designated for offshore PV installation and could accommodate more than 70 GW of floating PV capacity. Coastal provinces such as Shandong, Jiangsu, and Zhejiang have unveiled ambitious offshore PV development blueprints with construction of almost 60 GW of generation capacity planned.

Despite the current cost of floating solar being 5% to 12% higher than onshore PV, the plummeting price of modules has propelled offshore PV nearer a positive return-on-investment. In November 2023, the Haiyang HG34 power plant, boasting an impressive installed generation capacity of

2.7 GW, commenced operation off the coast of Shandong province. The growth of offshore PV still faces hurdles such as a dearth of supportive policy and heightened climate-change related risk, however.

Prospects for 2024

Looking ahead to 2024, there are several key areas of focus for the Chinese PV industry. Firstly, the sector is concerned about PV module prices. Facing the dual pressures of production capacity increases and falling demand, there is speculation module prices may fall further. There have been unconfirmed reports since November 2023 suggesting that tier one wafer, cell, and module producers are facing more frequent factory shutdowns and opting for limited production to maintain prices and margins. It remains to be seen whether limited production can stabilize or drive module prices up.

Secondly, China’s PV supply chain is grappling with overcapacity across all its nodes. New production capacity is expected in 2023 and 2024. Overcapacity could cause substantial losses, bankruptcies, and the restructuring of numerous enterprises. It remains to be seen whether any of the large solar manufacturers will suffer the same difficulties as big-name predecessors Suntech, Yingli, and LDK.

China’s economy is experiencing a downturn, with manufacturing output stagnating or declining and electricity demand expected to remain flat, or to fall. Given the challenges related to consumption and low returns, power plant investors could see their appetites significantly reduced. A decline in installed capacity may drive an industry-wide recession.

The primary concern for 2024 is the volume of new solar generation capacity that can be expected. Increasing reliance on renewable energy has raised concerns about grid stability.

Since October 2023, several Chinese provincial governments have temporarily suspended approval for ground-mounted or distributed PV projects. Those decisions stem from fears that grids will not be able to accommodate additional intermittent energy sources. Will the situation improve in 2024? If not, it will undoubtedly have a significant impact on new solar capacity. In fact, annual new PV capacity may actually decline in 2024.

What is certain is that TOPCon is on track to become a mainstream product. The market space for HJT and xBC cells remains uncertain, however, and the possibility of a commercial breakthrough with perovskites still hangs in the background.

Regardless of the global landscape, China’s 30-60 carbon targets safeguard the long-term trajectory of the PV industry. While short-term setbacks may occur, the industry will inevitably experience a resurgence.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.