https://www.pv-magazine.com/2022/10/24/chinas-solar-cell-production-capacity-may-reach-600-gw-by-year-end/

China’s solar cell production capacity may reach 600 GW by year-end

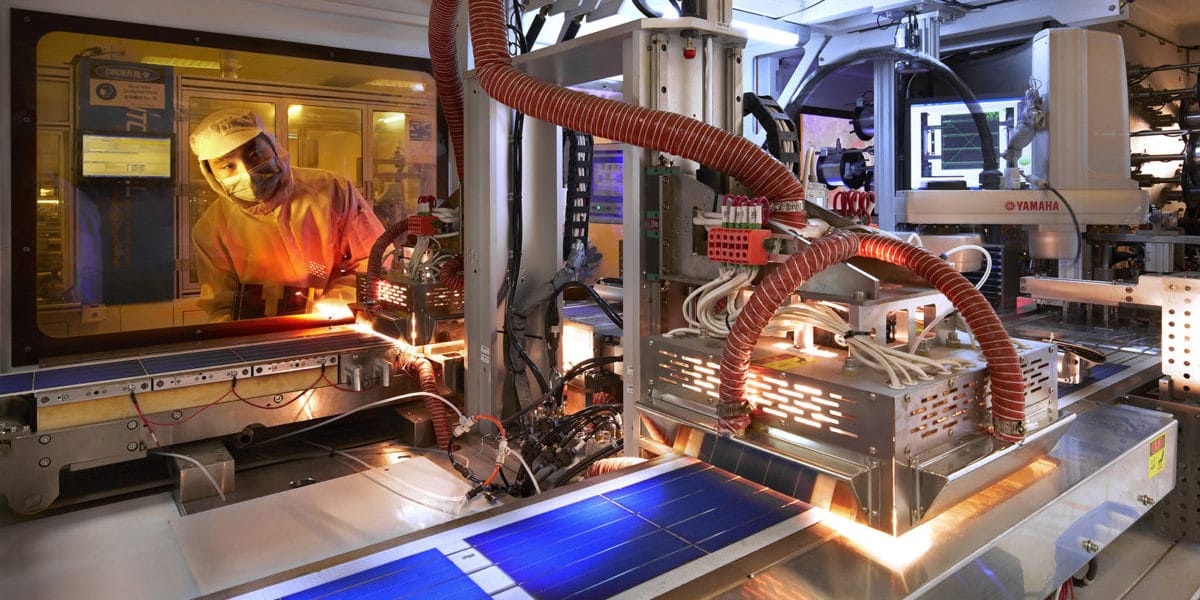

Image: Trina Solar

China's total annual solar cell and module production capacity may increase from 361 GW at the end of last year to up to 600 GW at the end of 2022, according to the Asia Europe Clean Energy (Solar) Advisory (AECEA).

“Since January, 20 companies disclosed to expand module production totaling 380 GW, planned to be executed within the next few months or up to 1,5 years,” the analyst firm said, noting that most of this capacity relates to n-type modules produced with tunnel oxide passivated contacts (TOPCon) solar cells or panels based on cells with a heterojunction (HJT) design. “Reportedly, TOPCon related expansion plans exceed 220 GW, whereas HJT is nearing the 150 GW mark. As an example, recently one HJT company conducted an online pitching and according to them almost 800 people joined that call,” it added.

So far this year, the output of polysilicon, wafers, cells and modules has already beaten the achievements of the Chinese PV industry in 2021 by some 50%. “By June, module shipments of the TOP 10 manufacturer crossed the 100 GW and by the end of September may have reached 140-150 GW (2021: 133 GW),” said the AECEA. “Just five of these top 10 have set shipment targets of between 183-205 GW.”

Popular content

Furthermore, the AECEA revealed that the country's polysilicon capacity should grow from around 530,000 MT at the end of 2021 to up to 1.2 million MT in 2022, jumping to 2.5 million MT in 2023, and up to 4 million MT in 2024.

“In the near term, the overall industrial landscape won’t fundamentally change. Incumbent companies are further consolidating their market positions through backward/forward integration,” the AECEA stated. “By and large, vertical integration remains their favored business model, which in times of external supply constraints or external supply dependencies has gained ever more weight.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.