http://www.iccsino.com/news/show-htm-itemid-16840.html

Cathode | Prices of Lithium carbonate and Lithium hexafluorophosphate fell

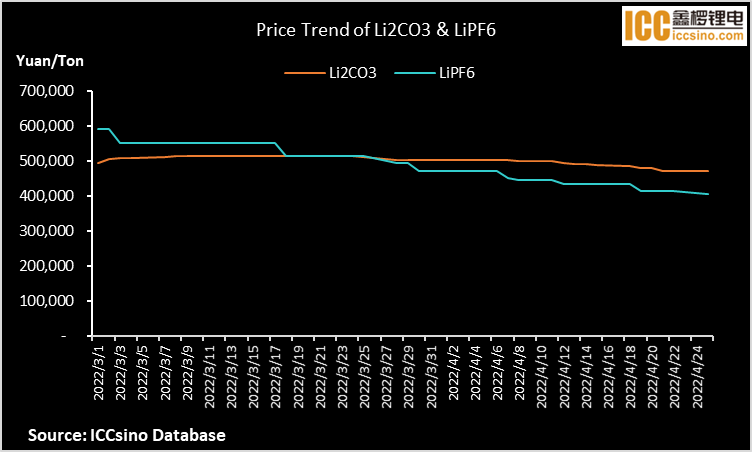

Lithium carbonate fell another 2,000 yuan to 465,000 yuan / ton Lithium hexafluorophosphate fell to 400,000 yuan / ton.

The domestic battery-grade lithium carbonate quotations continue to decline, the current quotation range has fallen to 465,000-475,000 yuan / ton. With a single day down 2,000 yuan, the decline has narrowed compared with the previous trading days.

Domestic battery-grade lithium hydroxide went down with it, and the spot quotation has dropped to the price of 482,000-490,000 yuan / ton, down 1500 yuan / ton in a single day, still above lithium carbonate.

Lithium hexafluorophosphate, which has expanded during the whole year of 2021, is still difficult to escape the fate of falling, with a single-day decline of 25,500-40,000 yuan / ton. The current spot price range is 330,000-480,000 yuan / ton, and the average spot price has dropped from more than 590,000 yuan / ton at the beginning of the year to about 405,000 yuan / ton currently, primarily caused by the increase in the supply of new capacity on the supply end.

In addition, after 11 consecutive trading days of stability, lithium metal was loosened today's quotation, falling to 310,000-319,000 yuan / ton, the average price was 314,500 yuan / ton, down 15,750 yuan / ton in a single day.

In terms of lithium carbonate, the supply may have a slight increase in performance this month, and the demand, affected by the fermentation of the epidemic, although the car company has entered the recovery and commissioning stage, but the impact of the previous shutdown is still there. The superimposed import increase is significant, and the supply and demand reduction has achieved a certain reversal on the short-term supply and demand market. For the future price, it is expected that some manufacturers will replenish the warehouse next week, the market transaction may increase, and the price may fall slightly.

In terms of lithium hydroxide, on the demand side, the trend of lithium hydroxide at home and abroad is opposite. Foreign lithium hydroxide procurement is optimistic, and the procurement demand is relatively strong. Domestically, some manufacturers' high-nickel material orders have been clearly reduced, and the order decline superimposes some material enterprises in the long-term purchase and the option of lithium salt supply, and the spot procurement demand has weakened. In addition, due to the continuous downward impact of lithium carbonate prices, the price of caustic processed lithium hydroxide has also challenged the current price. The future market expects that due to the downward price of lithium carbonate and the weakening of the procurement demand of downstream material factories, the price of lithium hydroxide may still decline slightly.

It is worth mentioning that although the recent lithium salt price continued to decline, but still in the high level for many years, therefore, many battery companies have raised battery prices. CATL and Farasis and other battery producers announced price increases, Aucksun also admitted that in order to cope with the rise in raw material prices, the company's lithium-ion battery sales price has risen this year.

Some local stock companies believe that the current lithium salt supply increase and demand reduction pattern led to a slight decline in prices, this year's increase in the mine end is limited, superimposed downstream new energy vehicles and other accelerated resumption of production is expected to form a strong support for lithium salt demand, lithium salt prices are still expected to maintain a high level.