https://www.pv-magazine-australia.com/2022/04/09/weekend-read-big-battery-breach/

Weekend read: Big battery breach

As the sun sets on some fossil-fuel generators, batteries are required to bolster the grid.

Image: Neoen

From ISSUE 04 – 2022.

The Australian Energy Regulator (AER), the nation’s energy cop, has taken Neoen’s 150MW Hornsdale Power Reserve (HPR), otherwise known as the “Tesla Big Battery,” to Australia’s Federal Court for allegedly failing to deliver frequency control ancillary services (FCAS) for which it was contracted to provide from July to November 2019. AER Chair Clare Savage said the services “are required to keep the lights on following a power system disturbance,” and HPR’s failure “created a risk to power system security and stability … It is vital that generators do what they say they do if we’re going to keep the lights on through the market’s transition to variable renewable generation.”

According to Georgios Konstantinou, a senior lecturer in energy systems at the University of New South Wales’ School of Electrical Engineering and Telecommunications, “providing FCAS and other frequency support functions is one of the major roles that HPR, and for that matter most of the battery energy storage systems (BESS) that are connected to the grid, are expected to play. FCAS is also the main ‘income’ source for BESS in the National Electricity Market [or NEM].” Indeed, profits from such services, particularly in response to a major network disruption event in South Australia, prompted Neoen’s 50% expansion of HPR in 2020.

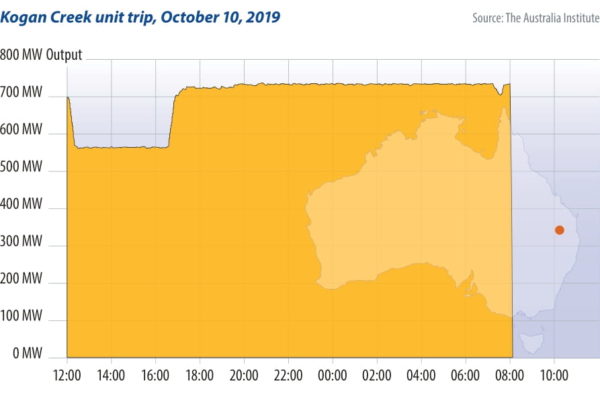

The key event within the alleged period, for which the Australian Energy Market Operator (AEMO) notified the AER, was HPR’s failure to deliver its full dose of stability services during a major grid disruption emanating from the tripping of Australia’s newest and most troublesome coal generator, the 750MW Kogan Creek Power Station in southeast Queensland. “Losing 750MW in a single unit from the NEM is probably as bad as it gets for a single event,” said Konstantinou.

Guillaume Roger, an associate professor at Monash University who is currently setting up the institution’s Australian Electricity Market Initiative and associate director of the Monash Energy Institute, told pv magazine that AER’s claims are grounded on facts that are not disputed. “For the incident in question, HPR only supplied less than half the power it should have under the terms of the agreement. The reason is that the software settings of the inverter were set at an insufficiently sensitive level following a firmware/software upgrade from Tesla, and this was overlooked by the HPR engineers.”

And yet, despite the significant trip at Kogan Creek, the lights stayed on. As Roger put it, HPR’s “failure had no material impact on the grid.” And what is more, “HPR returned the excess payment to the market operator; so it did not gain from the operation.”

Possible outcome

Fortunately, this incident was collectively contained by other network contributors, but the software error could’ve proven disruptive, and possibly realised the AEMO’s fears of the lights going out. However, as Konstantinou observed, when the loss to the system is of a magnitude over 700MW, as it was in the case of Kogan Creek, “I do not think that any of the HPR settings would have made any difference.” Nevertheless, Konstantinou says this may not be the case as more BESS joins the grid, and more traditional synchronous generators such as coal and gas retire. As this happens “the promised capability becomes more and more important.”

Monash University’s Roger agreed, adding that the “dramatic transition to renewable energy” makes standby capability “even more critical. Furthermore, it is particularly important in South Australia, which has no coal-fired plants anymore, and only a handful of gas-fired plants.” Looking at it from a different perspective, what Roger called “a speculative mind,” it could be suggested that the legal dispute is “a signal to take these ancillary markets seriously.”

Sledgehammer meets nut

The regulator’s claims cannot, therefore, be said to be without substance. But what makes the case controversial is not that a generator failed to perform as promised, but that it is only batteries, the new kid on the block, that seems to be so summarily punished. Is this a case of the AER wielding a sledgehammer to crack a nut?

A source close to the case put the original pecuniary penalty sought by AER at some AUD 10 million ($7.4 million). To put that in perspective, the regulator fined the Queensland state-owned generator CS Energy (which owns Kogan Creek Power Station) AUD 200,000 for the sluggishness of its fossil-fuel generators to provide FCAS services over multiple incidents across a two-and-a-half year period, including a major incident on Aug. 25, 2018, resulting in widespread outages on almost every part of the grid except South Australia, thanks to its utility scale and distributed fleet of batteries.

According to a report from Canberra-based think-tank The Australia Institute’s Gas & Coal Watch, the Kogan Creek Power Station is the single most unreliable generating unit on the NEM, breaking down 13 times over a two-year survey period. In all, the report recovered 93 breakdowns at Queensland gas and coal-power stations in that period. Indeed, BESS are part of a package of solutions to cover the increasing unreliability of thermal power generators.

Dan Cass, energy policy and regulatory lead at The Australia Institute, told pv magazine that “Australia is on a steep learning curve keeping up with rapid and disorderly coal retirements. The most important insurance policy is to build more big batteries like HPR. If the AER’s action deters investment in batteries that would be a very perverse outcome for consumers … The AER’s action seems ill advised and raises questions about the regulator’s priorities.”

When asked if AER has been as litigious with coal and gas generators as it has with HPR, Roger replied in the negative. “The AER has been at best a toothless tiger and at worst, politically captured either by the fossil fuel lobby or by the federal government,” he added. “In addition to these breakdowns, for years there have been blatant abuses of market power in the NEM, as well as market manipulations, which the AER has not pursued.” Roger noted that in AER’s defence, such manipulations are difficult to prove, “although everyone knows what is going on.”

Despite huge potential for renewables and BESS in Australia, the country’s federal politics remain consumed by what has been dubbed its “Climate Wars”. And AER Chair Savage seems to have chosen her side a long time ago.

Savage arrived at the AER in 2019 after a long career in energy that has rarely seen her on the side of a swift transition to renewables. Indeed, she was previously the executive director of policy at the Business Council of Australia (BCA) when the organisation verged on climate-denialism. In 2018 the business group described the opposition Labor Party’s proposal for a 45% emissions reduction target for 2030 as “economy wrecking.” In 2021 the BCA reversed its position, declaring a 50% target by 2030 a necessity lest Australia lose its competitive advantage in renewables and “be left behind and pay the price.”

“(Savage) has not worked for the consumer,” said leading energy analyst Tim Buckley, director of Climate Energy Finance. “She has not even worked for a company that worked for the consumer. And now she is working for Angus Taylor [Australia’s Minister for Industry, Energy and Emissions Reduction], who has no one but the fossil fuel industry in mind.” Buckley is certainly not the only energy industry insider to tell pv magazine that Savage is eager to please Prime Minister Scott Morrison’s desire to prop up the coal and gas industry.

As iron ore magnate and green hydrogen pioneer Andrew Forrest told the Queensland Media Club on Feb. 25: “Taylor is standing in the road of both the market (never a wise decision) and the concluded science of climate change. What bothers me the most is that this rear-vision loyalty is standing in the road of Australia’s real and proper destiny … of becoming a pollution free nation exporting pollution free products and fuels all on a scale to dwarf the iron ore industry … Minister Taylor pays lip service to green energy but takes action for fossil fuels.”

Forrest finished by asking the assembled media what the difference was between Angus Taylor and God, the answer: “God doesn’t think he’s Angus Taylor.”

Worst case

Most agree that the Federal Court case in question is unlikely to reverse the enormous momentum building for batteries in Australia. Nor should it harm these batteries’ future business. The FCAS market will remain the key focus of battery developers like Neoen. As Roger put it: “At current costs and arbitrage performance, storage operators do not break even by simply buying and selling energy … I hasten to add this is not easy, and that the current market design is not conducive of systematic energy arbitrage. This will likely change as costs decrease.”

In the meantime, batteries like Neoen’s other big battery, the Victorian Big Battery (VBB) “is mostly on standby as a power reserve through an agreement with the Victorian state government.” This is to say that the business case for batteries “is not made yet” by clear market price signals alone, and thus the HPR breach is unlikely to have an impact. As Neoen Australia managing director Louis de Sambucy said in response to the legal action: “Whilst we are disappointed by the AER decision, we will continue to maintain our collaborative relationship with them.”

According to Konstantinou, what would impact battery deployment would be if it or renewables in general were to become associated with higher prices (the trend is the other way), or if there is a more visible event like a technical failure or a fire. Of course, the VBB did suffer a fire last year during its commissioning, but the event was isolated to two Tesla Megapacks and barely delayed the project’s launch.

At the most recent Hornsdale-case hearing, on Feb. 24 2022, Federal Court Justice Besanko reserved judgment. But whispers have been heard from close to the case suggesting a settlement is near at hand for a fraction of the initial unconfirmed figure of AUD 10 million, a fraction more in line with the penalty given to CS Energy. Those same whispers also described the case as a “witch-hunt,” in which big batteries are being burned at the stake.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

<