http://www.iccsino.com/news/show-htm-itemid-16872.html

Battery | A big bet by OEMs and Capital, when will the solid-state batteries

Entering 2022, the news that OEMs bet on solid-state batteries continues to come out. In addition to car companies betting, since the beginning of this year, a number of solid-state battery industry chain enterprises at home and abroad have successively gained capital favor. At the same time, battery materials enterprises have also accelerated the research and development and production of solid-state battery-related materials.

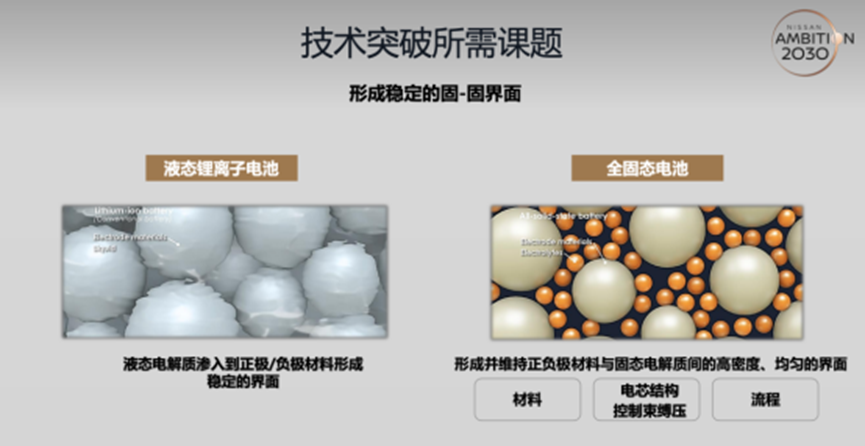

With the advantages of safety, high energy density, high recyclability, low cost, and green environmental protection, solid-state batteries stand out in the battle of new power batteries and become the next-generation technical route direction for car companies to bet on, capital favor and the battery industry chain to compete for layout. At the same time, due to restrictions such as equipment and manufacturing processes, the market is more focused on the commercial application of solid-state batteries.

A bet made by OEMs

Entering 2022, the news that car companies bet on solid-state batteries continues to come out.

On April 12, Honda Motor announced its latest initiatives in the pure electric vehicle business. In order to achieve carbon neutrality through all-field products and corporate activities in 2050, Honda Motor will accelerate the independent research and development of next-generation batteries in the second half of 2020s, and plans to invest about 43 billion yen to build a demonstration production line for all-solid-state batteries currently under development, which will start in the spring of 2024. After it is completed and put into production, it is planned to be used in the models launched in the second half of the 2020s.

On April 11, Nissan officially announced a pilot production facility for stacked pouch all-solid-state battery cells located at the Nissan Automotive Research Center in Kanagawa Prefecture, Japan, aiming to further promote the development and application of all-solid-state batteries. In the "Nissan Vision 2030", Nissan plans to build a solid-state battery pilot plant in Yokohama, Japan, by fiscal year 2024. By fiscal 2026, a total of 2 trillion yen (about 112.8 billion yuan) will be invested to accelerate the transformation of electric technology. At the same time, Nissan plans to achieve large-scale mass production of solid-state batteries in fiscal 2028, and launched the first electric model equipped with an original all-solid-state battery in the same year.

On March 6, BMW rarely put forward its own views on power exchange technology, believing that the power exchange technology route is a waste of time, and BMW is more pursuing solid-state battery technology.

On February 1, Mercedes-Benz signed a technical cooperation agreement with Taiwanese solid-state battery company ProLogium to jointly develop next-generation batteries, with an investment of millions of euros. The first model with a new solid-state battery is expected to be launched in the coming years and will be installed in a range of passenger cars over the next five years.

In addition, there are Dongfeng, NIO, SAIC, BAIC, Great Wall, Toyota, Volkswagen, Ford, Stellantis, General Motors, Hyundai and many other domestic and foreign car companies to increase the layout of solid-state batteries.

A favor by the capital market

In addition to car companies betting, since the beginning of this year, a number of solid-state battery industry chain enterprises at home and abroad have successively gained capital favor.

On April 24, according to the news released by the new electrolyte material high-tech enterprise Liongo, in February this year, Haisong Capital, together with Jingneng Technology, CAS Funds, Jiuzhi Capital, Huangcheng Xiangfu and other well-known investment institutions and enterprises signed a round of equity investment agreement with Liongo, and the delivery of funds has been completed recently, with an investment amount of nearly 200 million yuan.

On March 24, Welion underwent industrial and commercial changes, adding many shareholders such as Xiaomi, Huawei, Geely etc., and the registered capital of the company increased from 58.0368 million yuan to 61.3673 million yuan.

On March 14, BGE announced that it has recently completed more than 50 million yuan of financing. This round of financing is led by Tongchuang Weiye, and the investors also include CICC, Sunwoda, Zhuhai High-tech Venture Capital and other institutions, and the financing will be mainly used to accelerate the product layout, technology research and development, and talent introduction of all-solid-state batteries in the high-energy era.

On March 8, Country Garden Venture Capital released news that recently, TNE announced the completion of the A+ round of financing, which was exclusively invested by Country Garden Venture Capital. This round of financing will be used for production line construction, product research and development and talent construction.

On February 10, Enpower (including Enpower's solid-state battery companies in China, Japan and the United States) announced the completion of a round of financing of more than 100 million yuan, which was led by Microlight Venture Capital, followed by Borun Capital, Yuannuo Tiancheng, Green Capital and Potential Energy Capital.

On February 3, SES issued a $275 million PIPE offering at a price of $10.00 per share, with investors including Honda, General Motors, Hyundai Motor, Geely Holding Group, Kia Corporation, SAIC Motor and others.

On January 21, US solid-state battery startup Factorial Energy announced a $200 million Series D funding round led by Mercedes-Benz and the Stellantis Group.

Industry acceleration

On April 22, Japan's Ministry of Economy, Trade and Industry said that Japan will achieve full commercialization of all-solid-state batteries around 2030. With the bets of car companies and the favor of capital, the market is more focused on when to get on the car.

- Ganfeng: On January 22, Ganfeng Lithium-ion Battery has delivered 50 semi-solid-state battery electric vehicles to Dongfeng Motor;

- Samsung SDI: On March 14, South Korean battery manufacturer Samsung SDI announced that it broke ground on its all-solid-state battery test line, and the company will start mass production of solid-state batteries from 2027;

- Guoxuan: Guoxuan Hi-Tech has developed solid-state battery products with energy density greater than 360Wh/kg, which have been recognized by car companies and project fixed points;

- Anwa: Anwa New Energy semi-solid power battery industrialization project is advancing rapidly, and it is expected to achieve vehicle loading in the third quarter;

- BAIC Bluepark: BAIC Bluepark has completed the development of the second generation of solid-state batteries, battery system bench test verification and vehicle mounting verification;

- NIO: NIO plans to install a solid-liquid battery pack with a capacity of 150 kWh on the new MODEL ET7 in 2022;

- SAIC: SAIC Motor plans to put into production in 2025 the world's leading solid-state battery;

- SVOLT: Great Wall Brothers SVOLT previously announced that the energy density of its solid-state battery cells can reach 350-500Wh/kg, and it is expected that the models equipped with this battery can achieve mass production in 2025;

- Toyota & Panasonic: Toyota and Panasonic are expected to sell cars equipped with solid-state batteries around 2025;

- VW: VW plans to start mass production of its solid-state batteries in 2024;

- BMW: BMW plans to start road testing of vehicles equipped with all-solid-state batteries by 2025 and achieve mass production by 2030;

- Stellantis: Stellantis plans to launch its first solid-state battery technology by 2026;

- LGES: LG Energy Solutions plans to start mass production of polymer-based all-solid-state batteries and more in 2026.

As can be seen, most companies are expected to start producing all-solid-state batteries in 2024 or 2025.

Research institutions predict that in 2030, the shipment of solid-state batteries worldwide will reach 276.8GWh, and the overall penetration rate is expected to remain around 10%.

In order to seize the commanding heights of next-generation battery material technology, battery material enterprises such as Ronbay Technology, EASprng Technology, Shanshan, Semcorp, Tinci Materials, Guotai and GEM have also accelerated the research and development and production of solid-state battery-related materials. Among them, on April 26, Ronbay Technology was ordered by Welion solid-state Lithium-ion Battery cathode materials, supplying more than 30,000 tons in 4 years.

Power battery technology innovation will be accelerated, and heavy safety, energy, cost reduction will become the general direction, and solid-state batteries are expected to accelerate the loading of vehicles under the efforts of the industrial chain.