https://www.pv-magazine.com/2023/02/18/weekend-read-a-long-time-coming/

A long time coming

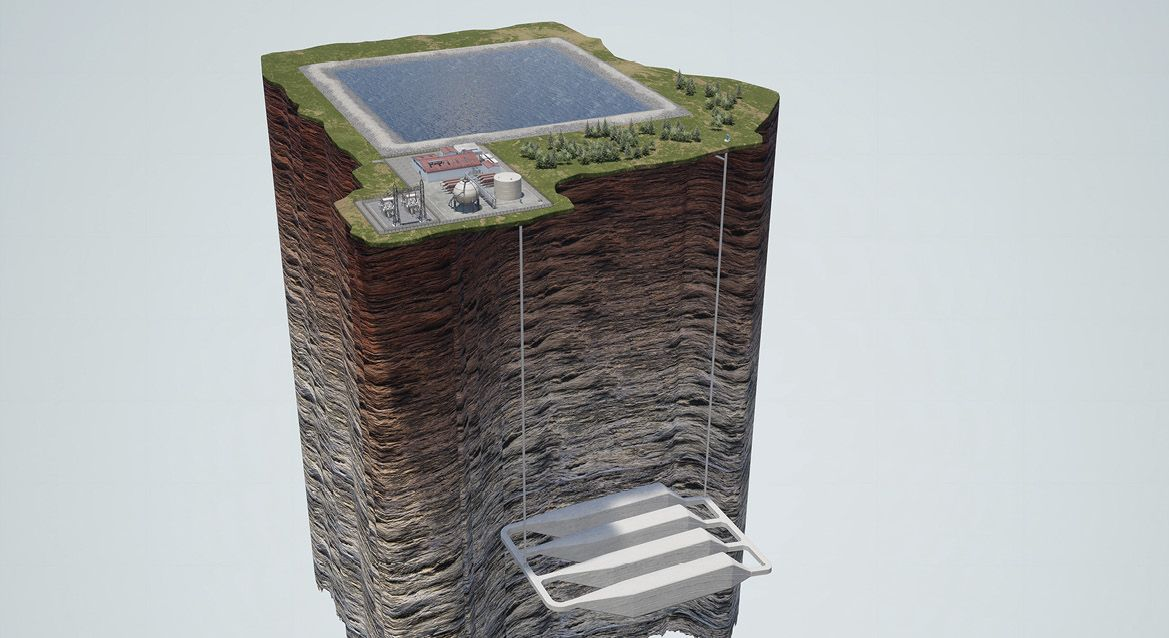

Canada’s Hydrostor is developing a 300 MW to 500 MW advanced-CAES facility in Ontario.

Image: Hydrostor

From pv magazine 02/23

As the penetration of renewables into the grid increases, storing intermittently supplied energy becomes increasingly valuable. The benefits of long-duration energy storage are evident: storing intermittent clean energy and pouring said solar and wind electricity back into the grid at periods of peak demand, ideally cheaper than conventional fossil fuel power.

The trick remains storing energy at scale. Yet where the green shoots of ideas and promise for LDES technology sprout, the roots are tangled among a graveyard of failed concepts.

Duration or application?

LDES is roughly defined as systems capable of delivering eight or more hours of storage capacity, though some place the cutoff point at 10 hours. A report by US federal body the National Renewable Energy Laboratory (NREL) recently tried to shift the focus of the definition from duration to application, arguing storage duration “does not indicate how the stored energy is used or the value it provides to the grid.” That said, it settled on a definition of “greater than 10 hours,” offered up by fellow government body the Advanced Research Projects Agency for Energy (ARPA-E). That description does fit most purposes and covers technologies that are new to the grid and those that have been in use for generations, such as hydropower.

Battery power

Lithium-ion batteries have capacity and power coupling issues that make them vastly expensive for long-duration storage. Cyril Yee – director at Massachusetts-based clean energy body the Grantham Foundation, and former chief innovation officer at climate technology entity Third Derivative – tells pv magazine lithium-ion batteries have significant problems of scale and lifetime.

“Something I’m not crazy about for lithium is the cycle-life, which isn’t very long – we’re talking around 3,000 cycles,” says Yee. “Grid assets are usually 20-year assets, that’s what utilities are used to dealing with. There’s no way a lithium battery will last 20 years and, for the most part, other battery technologies and chemistries are just as high-risk. In general, we’re bullish on the [LDES] space.”

Sam Lefloch focuses on industrial decarbonization as industry sector lead at Third Derivative, and emphasizes the point further. “If you go to tens or hundreds of hours of storage, you have to linearly increase the cost of the equipment that is used to charge and discharge.”

Funding issues

While LDES appears to be essential, and with investment more readily available from innovation and climate funds – both Yee and Lefloch say startups finding access to capital wasn’t an issue – the sector has struggled to go from promising ideas to promising businesses, with monetization a key issue.

“One concern we have is [LDES] near-term monetization, because the grid doesn’t necessarily need it until you get to very high penetration rates for renewables – 50-plus per cent,” says Yee.

Wood Mackenzie Senior Research Analyst Kevin Shang says utilities are particularly cautious. “The LDES ecosystem and novel technologies have been in labs and research institutes, but they are relatively new for utilities and still at a very early stage,” says Shang. “For utilities, their priority is to ensure resilience, stability, and safety of the power system. So it’s understandable that they have been slow, but things are improving.”

Lukewarm heat

One particularly tough field is thermal energy storage (TES), a technology which has attracted funding and early commercialized installations but has largely faltered to scale well. Wind engineering and power conversion supplier Siemens Gamesa has now ended its large scale and award-winning demonstrator project in Hamburg, Germany. The demonstrator site stored up to 130 MWh of energy as heat for as long as a week, using volcanic rock. Gamesa’s Verónica Díaz López was able to confirm to pv magazine that the project had ended despite proving technically feasible.

“Siemens Gamesa decided in the beginning of May 2022 to discontinue the demonstration operation of electrothermal energy storage,” says Díaz López, who put the decision down to a “lack of a commercial market for large scale storage.”

Among other contenders only Azelio, a Swedish company that stores energy as heat in recycled aluminum at up to 600 C, has managed to commercialize its solution. The company reports that it currently has 13 systems, known as TES. PODs. It is commercially operating across the UAE, Sweden, and South Africa, with its largest installation supplying up to 1.3 MWh of storage capacity.

Berlin-based TES company Lumenion says it has shifted to only storing energy for use as heat for systems with a capacity under 100 MWh. Elsewhere, Australian-based 1414 Degrees is now reworking its thermal energy storage system. MAN Energy Solutions, in Switzerland, found limited interest. Raymond Decorvet, a senior account executive at MAN, says that while the company has enormous demand for its industrial heat pumps, its TES business is less active. “I haven’t seen big movement on that, not on energy storage,” he says. “On heat pump storage, absolutely. I think it’s because of the question: who pays for it? Who benefits from it? We have to bring the barriers down.”

Popular content

One of the remaining TES hopes is Malta Inc, a company spun out of Google-owner Alphabet’s “moonshot factory,” X, which has received more than $85 million in investment. Malta has a pumped-heat energy storage demonstration facility installed at the Southwest Research Institute, a Texas-based non-profit group.

Compression hopes

Another major LDES hope, compressed air energy storage (CAES), has a 50-year track record, second only to pumped hydro in terms of installed scale. Two operations have been in use reliably since 1978 and 1991, in Germany (with a 290 MW capacity) and Alabama (110 MW), respectively. A study produced in 2002 by the Electric Power Research Institute found that some 80% of US geology was suitable for CAES.

The technology stores energy by compressing air and storing it in an underground cavern or a container. The air is later released to drive a turbine. The technology has a fast startup time, can store large amounts of energy, and improvements are still being made. CAES plants have boomed in China, where developers are utilizing disused mines. The world’s largest CAES site, at 350 MW/1.4 GWh, has begun development in a Shandong salt mine and may expand to 600 MW.

Hydrostor, a Canadian company with patented advanced compressed air energy storage technology, is one of the larger players outside China. With a $250 million war chest, Hydrostor counts Goldman Sachs among its investors. Among its projects, Hydrostor is developing a 300 MW to 500 MW advanced-CAES facility in Ontario and the company has secured a power purchase agreement (PPA) from community electric company Central Coast Community Energy for a proposed 500 MW facility in California.

Hydrostor CEO Curtis VanWalleghem says the company aimed to improve traditional approaches to CAES by eliminating the constraints of geology. Hydrostor advanced-CAES can be placed “anywhere there is competent hard rock at 600 m depth,” says VanWalleghem, which is “more than 50% of the world.”

“Hydrostor’s A-CAES technology can provide the same megawatts and megawatt-hours as pumped hydro power while using up to 10 times less land and up to 20 times less water,” added VanWalleghem.

The CEO claims his company’s solution is 60% to 65% efficient, with capital expenditure for the system “in the $2,500/kW range for eight hours, or $250 to $300 per kWh of storage capacity, for an asset with a 50-plus year life without performance degradation.” The system is monetized via PPAs.

Batteries flow

One of the biggest LDES electrochemical hopes is Form Energy, an alternative battery player with deep pockets. The company has raised more than $800 million for an iron-air battery that it says can store 100 hours of energy at system costs that are competitive with conventional power plants. Form’s first battery manufacturing facility is set for Weirton, West Virginia, with finished batteries expected in 2024.

Flow batteries represent another vector of hope. Vanadium-based redox flow devices are well understood, and a 2022 Chinese project installed a 400 MWh system. Other approaches using different materials – principally moving away from expensive vanadium – are also gaining market interest.

NYSE-listed iron flow battery specialist ESS recently expanded into Europe and with renewables investment in the US exploding, is readying supply for expected demand. Senior VP for business development and sales at ESS, Hugh McDermott, tells pv magazine how the company is ramping up production: “As fast as possible!” he says. “We’re moving quickly to do our part to meet expected demand in the LDES market. McKinsey & Company predicts that we will need 30 TWh to 40 TWh of LDES in the US alone by 2040.” ESS’ first fully automated battery assembly line has an annual production capacity of 75 MW, with McDermott noting plans to expand capacity to 200 MW.

“On a total cost of ownership, our energy storage systems are significantly less costly to own than lithium-ion,” adds McDermott. “This is partly due to the fact that our technology has no cycling limits and our products are designed for a 20-plus-year life with no degradation or need for augmentation.”

Technology company Third Derivative has backed half a dozen flow battery startups, including new generations of flow chemistry that use organic compounds and alternative materials to vanadium, such as zinc-air. But greater investment is required, says Wood Mackenzie’s Shang, adding, “The key thing is that deployment of [LDES] at large scale has a lot of benefits. As a society, the reward is great. But what we need to do now is more planning, more investment, and more action. We must invest today to reap the rewards of tomorrow.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.