https://www.pv-magazine-australia.com/2024/03/02/weekend-read-predicting-the-solar-future/

Predicting the solar future

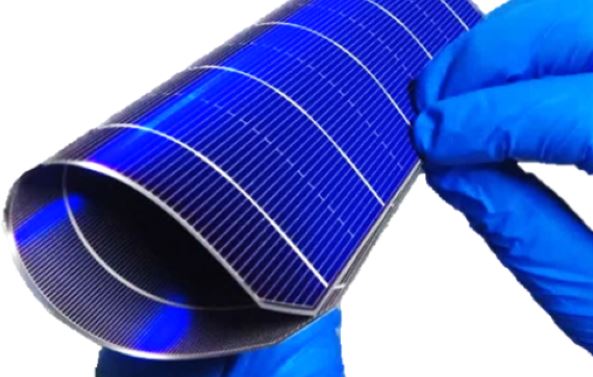

High production costs and raw material scarcity have slowed the adoption of HJT technology, despite its efficiency potential.

Photo: Meyer Burger

Now in its 14th edition, the ITRPV has become an influential report for the solar industry, documenting and forecasting supply chain trends from polysilicon to modules and solar bill-of-materials components.

The annual report is published by Verband Deutscher Maschinen- und Anlagenbau (VDMA), a German engineering association. It is based on responses to questionnaires sent to companies and individuals along the PV supply chain.

“The method has been the same since the first edition: Data collecting and analysis of median values and reporting highly relevant topics that are updated every single year by global steering committee members,” said Markus Fischer, vice president of R&D at South Korean module manufacturer Hanwha Qcells and chair of the ITRPV steering committee. “We aim to keep the reports simple, straightforward, yet targeting key factors having an impact on ingot and wafer, cell, module, and system level topics.”

Analysis of ITRPV predictions by scientists in Australia and the United Kingdom has highlighted the difficulty of solar industry forecasting.

“It’s long been known that there are things in the PV industry that either happen overnight or get delayed or even disappear,” said Matthew Wright, research associate at Oxford University. “The purpose of our paper was to actually provide evidence for that – to look back at the ITRPV predictions and see how things actually panned out.”

Wright worked on the analysis alongside researchers from Australia’s University of New South Wales, the University of Newcastle, and the Commonwealth Scientific and Industrial Research Organisation.

The analysis can be read in the paper “Historical market projections and the future of silicon solar cells,” published in academic journal “Joule.”

Rapid change

The solar industry’s switch from multi- to monocrystalline silicon is often cited as a fundamental shift that had not been widely foreseen. Multicrystalline silicon, produced using directional solidification, and consisting of a mix of crystals with different orientations, represented most of the market until 2018. At that point, concerns around degradation, new developments in cell and wafer processing, and other economic factors drove rapid adoption of monocrystalline silicon, which involves a seed crystal producing a single-orientation ingot.

The ITRPV was among industry watchers caught by surprise. The report’s 2018 edition predicted multicrystalline would represent around 45% of the market in 2022. It actually accounted for less than 3% by that point.

“Before 2018, there was a lot of multicrystalline and there was talk that the next big thing would be cast mono (an improved version of the multicrystalline manufacturing process),” said Wright. “But what the industry actually did is completely different, it just went straight to full mono.”

The ITRPV forecasts study also noted that, around 2018, manufacturers began to switch from aluminum back-surface field (Al-BSF) solar cells to a passivated emitter rear cell (PERC) design promising higher efficiency. By 2020, PERC represented more than 80% of the solar market, in another change the ITRPV was slow to observe.

“If you look at PERC, [ITRPV] projections from 2013 or 2014 suggest that by 2020 it’s only 40% market share, and another 40% still for Al-BSF which today seems crazy,” said Wright. “It’s a very clear illustration of a change in technology that moved much, much faster than what projections were suggesting.”

Other technological developments have moved more slowly than forecast. Heterojunction (HJT) has been known for many years as a potentially reliable, high efficiency cell technology. In 2015, the ITRPV forecast a 15% share for HJT cells by 2023. In reality it remained below 5% – though many still expect rapid growth by 2030. Tandem cells had been expected to reach as much as 6% market share by now but are yet to see any significant adoption.

Behind the trends

The study’s authors said they consider the ITRPV report valuable. They aim to highlight difficulties in long-term forecasting, with various causes. Some approaches, such as gallium doping of solar cells, have been held back by intellectual property restrictions, while others – HJT, for example – have been slowed by high production costs and raw material scarcity.

“For each case, we tried to give a reason and to point out that the reasons are varied and difficult to predict,” explained Wright.

Fischer noted that the VDMA has analyzed the accuracy of its predictions and has concluded that some trends are difficult to anticipate, particularly over the long term. The ITRPV is much more accurate on a two-year time frame, he said.

“Projections of the near future are much easier than looking 10 years ahead, much like the weather forecast for tomorrow is more accurate than one for two weeks from now,” he added.

Fischer noted the move from PERC to negatively doped “n-type” tunnel oxide passivated contact cells, and efforts to reduce silver content appear to be progressing faster than predictions made by the ITRPV in 2022 and 2023.

The ITRPV will continue its “crowd-sourced” intelligence gathering with the authors of the report into its forecasting noting that “business-as-usual projections must be assessed with caution.”

“The early ITRPV reports provided me with guidance throughout my years as a scientific researcher,” said Fischer.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

<