https://www.pv-magazine-australia.com/2023/05/23/maxeon-raises-300-million-for-ibc-module-manufacturing-expansion/

Maxeon raises $300 million for IBC module manufacturing expansion

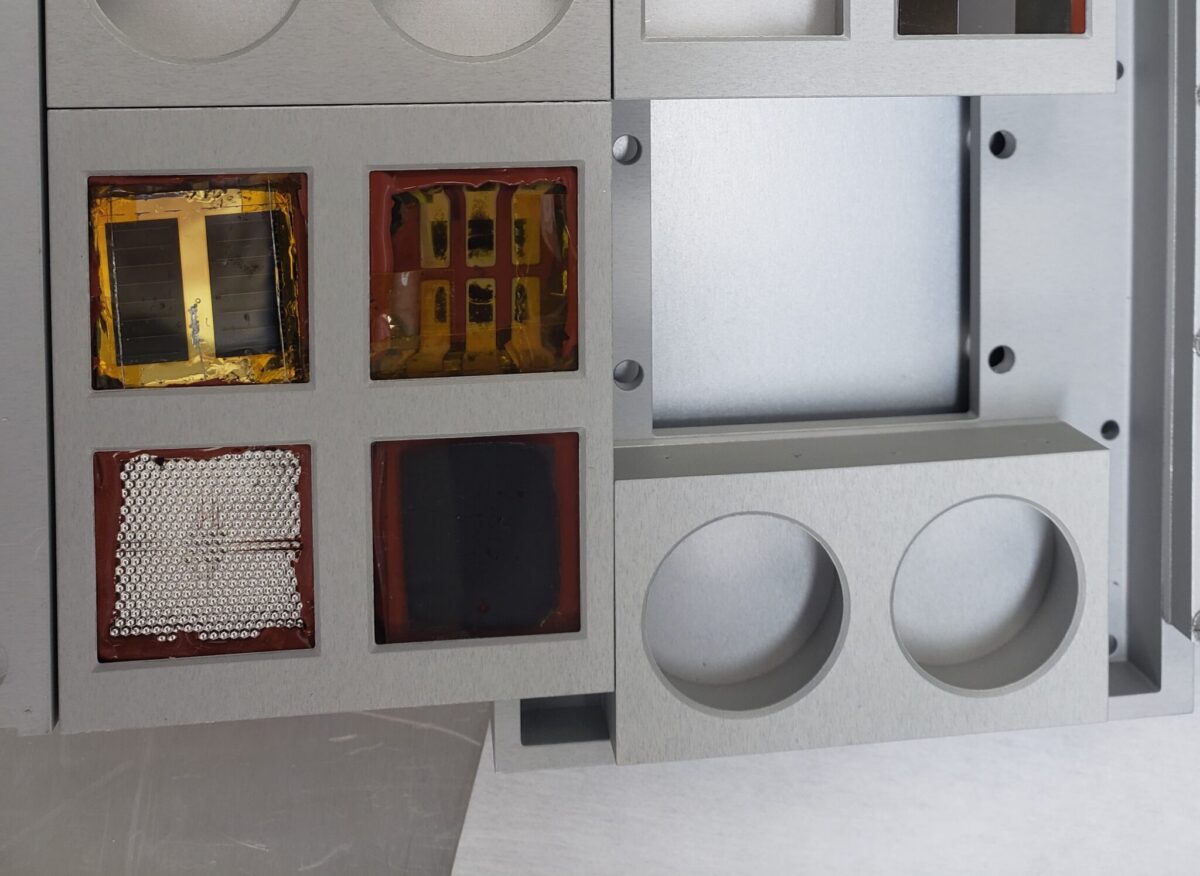

Image: Maxeon Solar Technologies

From pv magazine USA

Maxeon Solar Technologies has priced a public offering of shares to raise USD 157.4 million ($237 million) in equity proceeds. It said it would use the funds for Maxeon 7 module production and general corporate purposes.

Maxeon is selling 7.48 million common shares of stock, including 1.87 million shares of historic investor TotalEnergies, at a price of USD 28 per share. At closing, the company anticipates receiving more than USD 157 million in gross proceeds. The offering was upsized by 10% from an initial announcement that Maxeon made of selling 6.8 common shares, according to a company statement. The add-on public offering was expected to close on May 19.

BofA Securities and Morgan Stanley served as joint book-running managers for Maxeon’s offering. Raymond James and Roth Capital Partners were co-managers for the offering. In an additional private placement transaction, TCL Zhonghuan Renewable Energy, a current 23.7% shareholder in Maxeon, will acquire 1.5 million shares in Maxeon stock for about USD 42 million.

TCL Zhonghuan is a Chinese semiconductor manufacturer primarily engaged in the solar market. In July 2020, Tianjin Zhonghuan Semiconductor was acquired by TCL after the consumer electronics manufacturer won an auction to buy shares of its parent, state-owned Zhonghuan Electronic Information Group.

Maxeon is using the equity raise to fund the 500 MW capacity expansion of its cell manufacturing capacity for Maxeon 7 interdigitated back contact (IBC) panels, which is expected to increase its manufacturing capacity of the next-generation panels by about 50%, the company said. Maxeon 7 IBC panels are expected to be the world’s most efficient solar panels at approximately 24% module efficiency.

The IBC manufacturing expansion would utilise a previously closed Philippines warehouse with module assembly to occur at other existing Maxeon facilities. The Philippines facility will be designated as a “Fab5” facility and located near Maxeon’s existing Fab4 site, which currently hosts the Maxeon 7 pilot line.

Maxeon said Fab5 site production will ramp up in the second half of 2024. The company said new volume produced at Fab5 will be sold to the distributed generation (DG) markets, including expanding supply volume into a new U.S. residential channel market. Additional new Fab5 expansion capacity will allow more shipments to its European market and rebalance the mix of Maxeon and Performance line sales.

Total capital expenditures (capex) for Maxeon’s IBC expansion are USD 200 million, of which about USD 50 million is for site preparation and long-lead time items included in prior 2023 guidance. Including the USD 157.4 million and USD 42 million of add-on and private placement proceeds, the company’s 2023 capex budget remains at USD 150 million to USD 170 million, of which USD 100 million relates to the Fab5 ramp up.

Domestic content guidance

In US Securities and Exchange Commission (SEC) filings, Maxeon said the company’s management was reviewing the May 12 guidance from the Internal Revenue Service related to domestic content bonus incentives under the US Inflation Reduction Act.

For taxpayers using the Section 48 Investment Tax Credit (ITC), eligibility for the domestic content bonus would increase the credit by 10%, which in most cases is from 30% to 40% of the cost of a qualifying solar property. By power output, using the production tax credit (PTC) would increase by 10% as well as a result of domestic content eligibility.

“IRS guidance is supportive of our announced plans to deploy a multi-GW cell and module factory in the US to manufacture solar products for both the DG and utility-scale power plant markets,” said Maxeon said. “We are currently evaluating this guidance, which provides guidelines for how the solar products we will produce help our customers qualify for the domestic content bonus in the ITC and PTC and prescribes requirements for certain record-keeping and certification.”

Maxeon was spun off from SunPower in August of 2020, when both became separate entities. TotalEnergies owns a minority interest in Maxeon.

The company’s Performance line of solar modules leverage Maxeon’s shingled cell technology, originally developed by SunPower. The technology is protected by 83 granted patents. The 425 W modules use bifacial mono-PERC solar cells made on large-format eight-inch G12 wafers, and have an efficiency of 20.6%, according to Maxeon.

Maxeon is based in Singapore but lists shares on the Nasdaq Capital Markets exchange, where it currently trades at USD 28.66 per share today with a USD 1.3 billion market capitalisation. The company has 5,344 employees worldwide, of which based primarily in Mexico (39%), Malaysia (33%) and the Philippines (20%), according to its annual financial statement.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

<